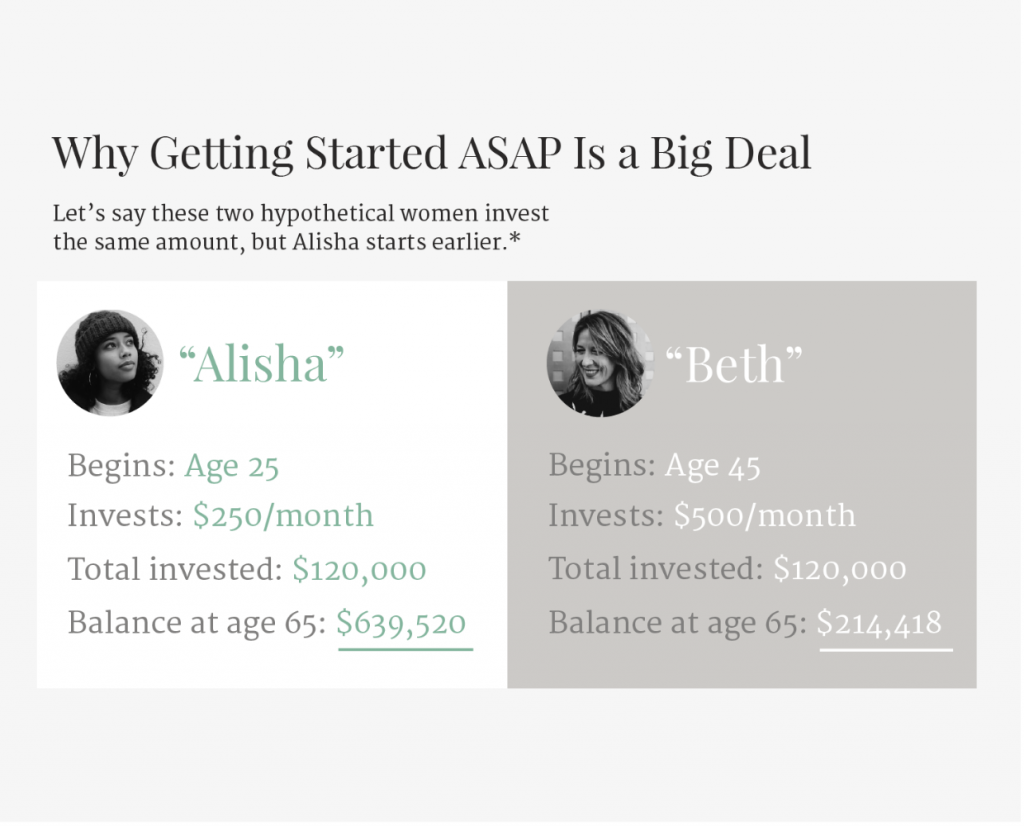

It’s easy to put investing off. It will be easier to start when you get that raise (which you probably will). It will be easier to start when you have more time (which you probably won’t). Or when you feel like you’ve learned enough about what it even means. But, it’s 2019 and it’s time to bring your ambition to your resolutions. It’s time to start investing.

The good news: You really don’t need to know as much as you think. A lot of women think they need to be a financial expert before they get started investing. You don’t. You only really need to know five basic things before you get started. That’s right: five basic things to know about investing before you get started.

But here’s the thing: Every single day you wait to invest could cost you about $100. Yep … a Benjamin. Every day.

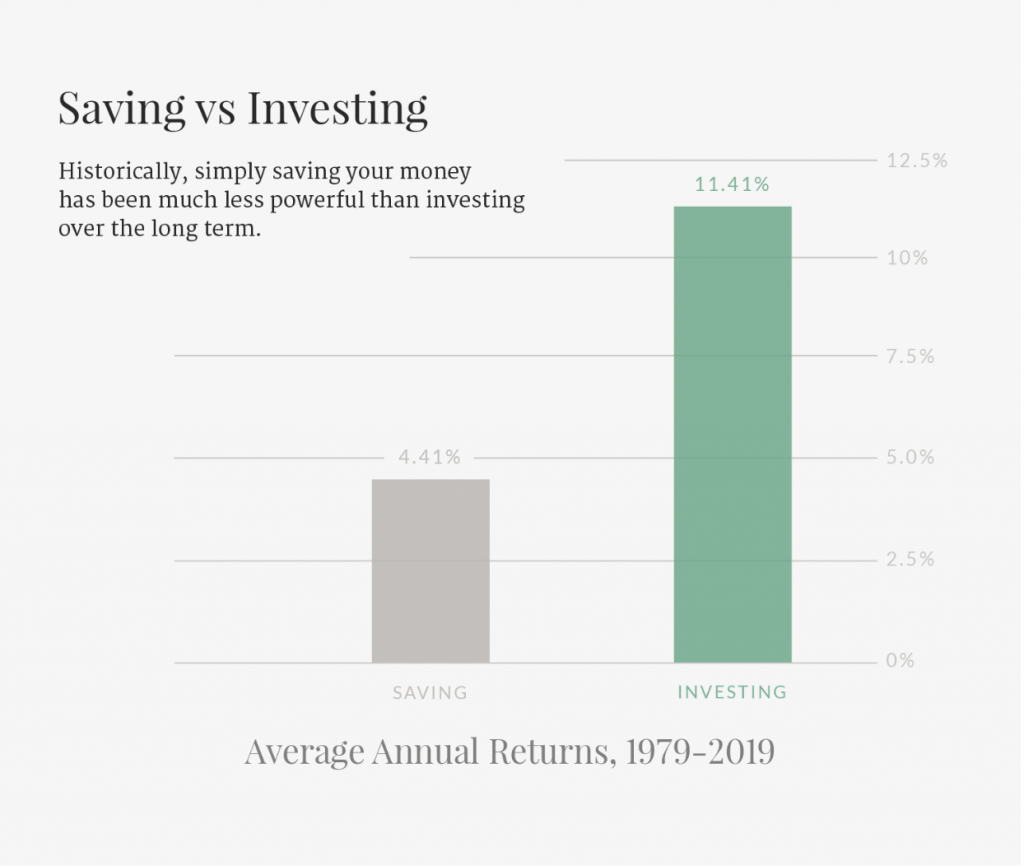

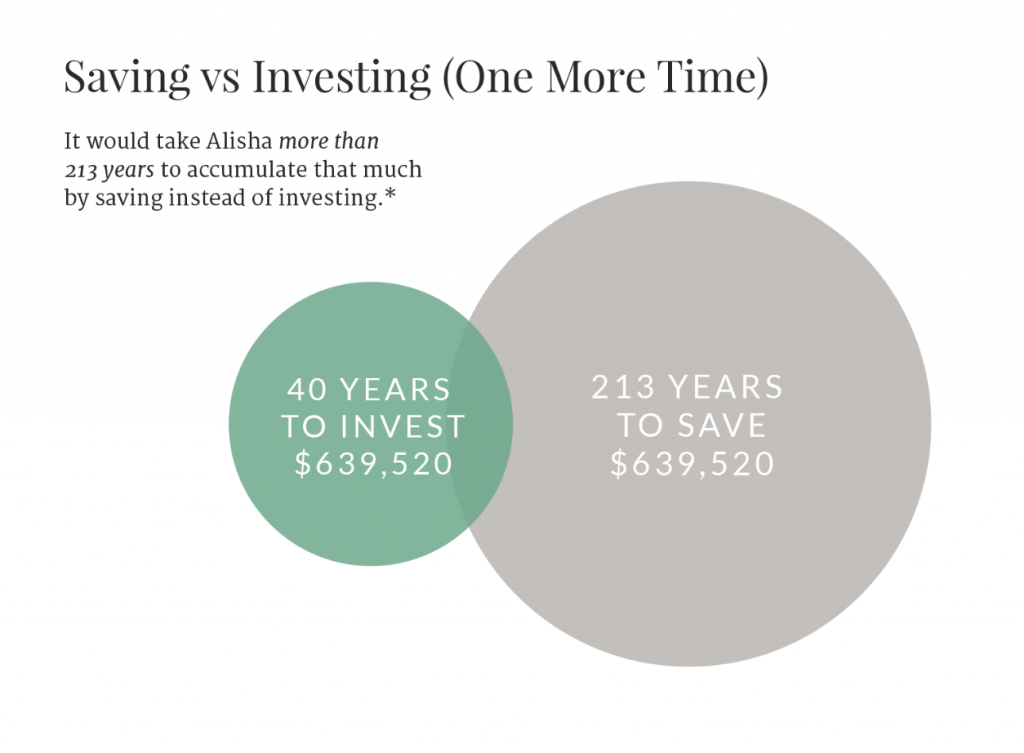

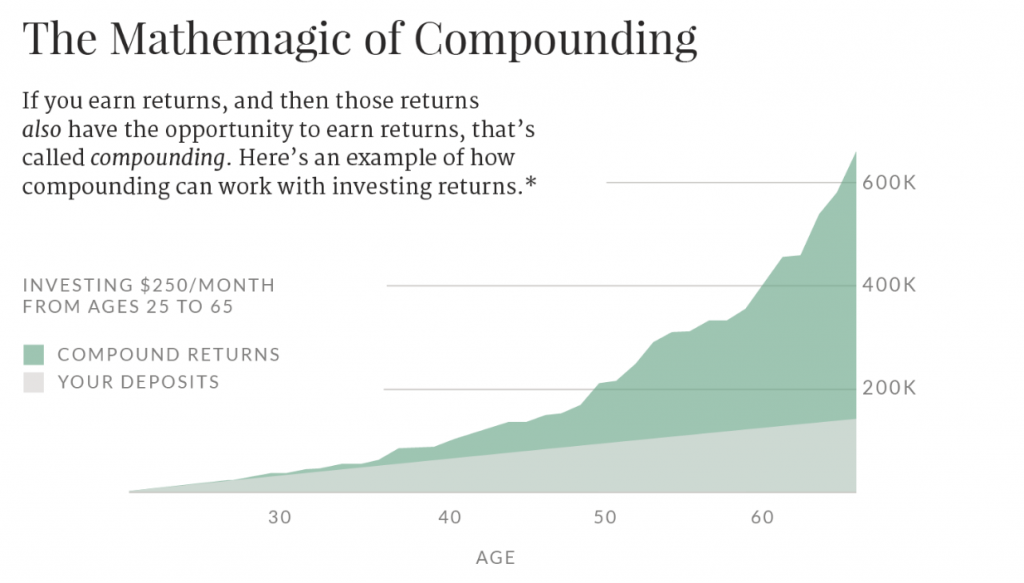

Here’s why you should start investing literally right now, from our friends at Ellevest.

In a planning mood? See how an investment plan could help you manage your finances. Ellevest is one way to do it. You can get a personalized portfolio in under 10 min. And it’s made by women, for women.

⇒ Get Started Investing With Ellevest

At Ellevest, they advise investing in low-cost exchange-traded funds, otherwise known as ETFs, where possible. And for a digital adviser, the management fee, the amount that adviser charges you, should be well below 1%. Ellevest’s are below that. So, don’t be afraid to ask how much you’ll be charged.

How do you start? Easy. You head to their website (here you go!), fill out a short questionnaire. Then, Ellevest suggests personalized investment portfolios that you can edit and set up with recurring deposits — so you don’t even miss the money.

In your investing quest, you may also encounter broker-dealers. Broker-dealers may also be called “financial advisors,” but they are not investment advisors or fiduciaries. They are not legally obligated to tell you when they have an interest in the security they are recommending for you. Yup, so the person you are hoping is watching out for your best interest is actually acting in their best interest. So, make sure to ask.

Bottom line

It can be fun spending money. It can be even more fun watching your savings grow. You’ll thank us later.

For when you don’t have a retirement fund…

Don’t sound the alarm – yet. Ellevest can get you set up in less than 10 minutes so you can reach all of your money goals. Sans judgment, finance jargon, and trust issues. Crisis averted. Get into it here.*