Tax refunds are nothing to sneeze at: last year, taxpayers received $3,000 back on average, but if you’re someone who absolutely must plan ahead or hates surprises, you can use this calculator to estimate your tax return. So what if I told you that you could actually grow your tax return into something much bigger than that (think: potentially life-changing), with quite a few ways to do it?

Whether you choose to put your tax return all in the same place or you choose to allocate your return in different ways, financial experts weigh in on how you can use your tax return smartly — so, there’s no need to be unsure of what to do with your tax return this year. I’ll walk you through five of those ways below.

Keep scrolling to find out more.

1. Pay Off Any High-Interest Debt

Ever have nightmares about your credit card debt and student loans? You’re not alone. Even though your tax return may not be able to cover all of your debt, it can certainly take some of that useless weight off of your shoulders so you can save your paychecks for something even better. Think of it as the government’s small gift of appreciation to you. LendKey can help you pay off your student loans by connecting you with community-based lenders so that you can enjoy lower rates, helping to pay off your student loans faster.

Don’t want to spend all of your money on paying off your debt? You don’t have to. Put a little bit of your return towards your debt and use the rest to invest for the future at the same time. Because why wouldn’t you want to have all of your bases covered?

2. Establish an Emergency Fund

Don’t have spare change in case your car breaks down? Set up an emergency fund beforehand so that you have something to dip into when life goes awry. A good rule of thumb is to set aside three months worth of pay as a cushion. Having an emergency fund doesn’t mean you’re a pessimist, it simply means that you’re being smart and practical with your money. Future You will thank you for not making a stressful time even more stressful!

In case stashing the cash under your mattress isn’t cutting it, you can set up an emergency fund with Ellevest. Best of all, they offer super low-interest rates and don’t charge a management fee because they firmly believe in the importance of having an emergency fund. Get started here.

3. Contribute to Your 401(k)

It’s easy to put off, but if you work for a company that will match 401(k) contributions, take advantage of it. It’s basically free money.

Even if your dream retirement party is a long ways away from now, it’s never too early to start building up your 401(k). If you can at all possibly contribute the maximum $18,500 per year, you totally should. Why? Because not only does it decrease your taxable income (aka, the government can’t take as much money from you as it could), but if you contribute up to your employer match (if you have one), that means even more free money for you.

If you’ve switched jobs and are going bonkers trying to juggle all of your 401(k) rollovers, give yourself a break and start a roll over with Ellevest. Their dashboard will conveniently organize all of your retirement accounts in one place, even if your career has been all over the place.

4. Contribute to Your IRA

Every dollar that you contribute to an IRA is a dollar off from your taxable income. Contribute that money you have now — this will lower next year’s tax bill, and your contributions will have an extra year to grow.

What’s the difference between a 401(k) and an IRA, you ask?

Anyone can have an IRA, whether or not you have a 401(k) through work. There are two popular types of IRAs: a regular IRA and a Roth IRA. With a regular IRA, you can contribute up to $5,500 per year and you won’t be taxed on that money until you withdraw it. As you probably guessed, with a Roth IRA, you pay taxes on what you contribute upfront and don’t have to worry about paying taxes on that money ever again.

Like with 401(k)s, you can transfer your IRAs to Ellevest and start investing towards your dream retirement today. Who doesn’t like the sound of making a one-time investment and watching it grow (and keep growing)?

5. Start Other Investments

Investing may seem intimidating, but it doesn’t have it to be. With digital investment companies, like Ellevest and Wealthsimple, the whole investment process is automated, meaning you can easily start investing and keep track of your money all on one dashboard.

Now more than ever, investing has emerged as an important and empowering tool for women seeking financial freedom. Sallie Krawcheck, CEO, and founder of Ellevest has said time and again that despite having more financial power than ever, women are not putting their money in the markets — and it’s costing them a lot. As she said in a recent interview, “The gender investing gap costs professional women tens of thousands, hundreds of thousand — in some cases, millions — of dollars over the course of their lives.”

It shouldn’t be a surprise that women are different from men when it comes to money. Women still earn less in the same jobs as their male colleagues. In 2018, female full-time workers earned, on average, 80.5 cents for every dollar earned by men. That wage gap is even broader for women of color.

To make the problem women, women are more likely to have gaps in their careers and income due to having children and taking care of elders.

These factors cause women to have less money saved for retirement… while at the same time we live longer and have larger retirement-age medical bills.

Clearly, women need something other than the traditional financial advice if they’re going to catch up to men with their investments.

How Does Ellevest Work?

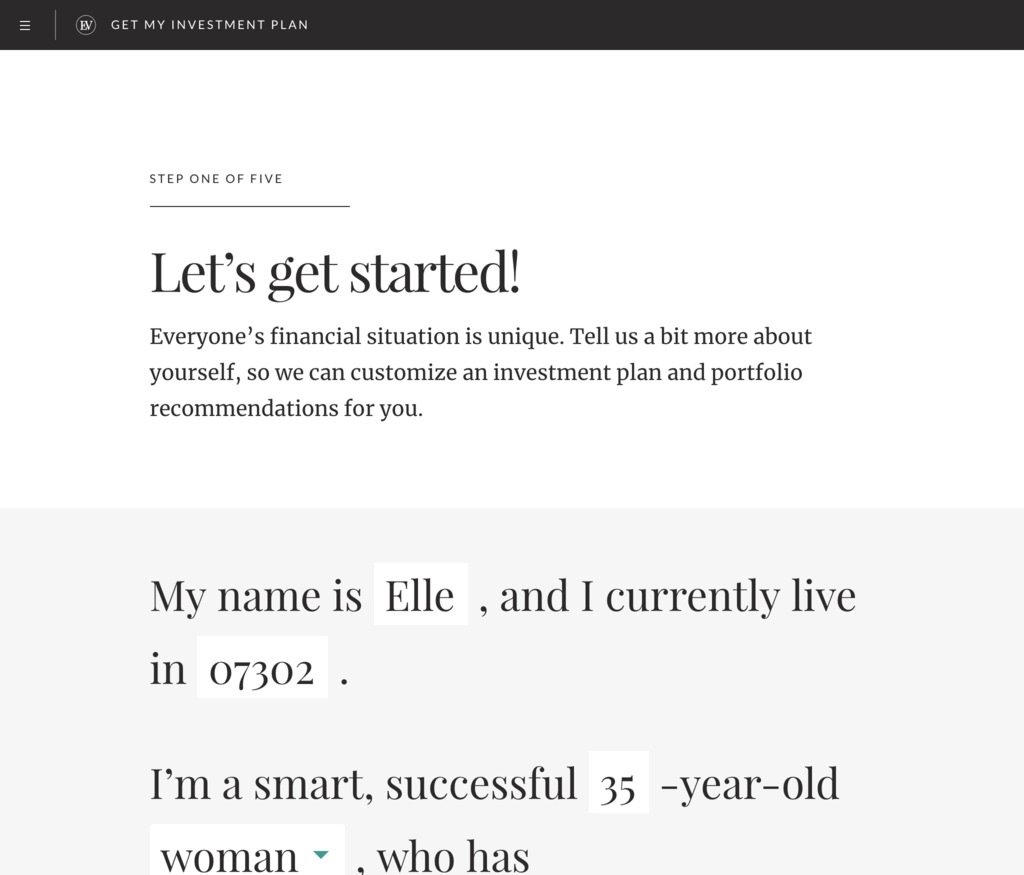

When signing up, clients enter their income, money goals, education, job, family responsibilities and other info. Ellevest then builds an investment portfolio based on salary projections, and other variables to give you advice on how to accomplish each goal.

Clients can change their goals themselves, and Ellevest will adjust their portfolios to match and with the clients’ individual goal timelines and risk tolerance in mind. In addition, Ellevest is an FDIC-registered fiduciary, so its advisors are legally obligated to keep your best interest first.

The best part? You can create your Ellevest financial plan for free, come back to it, modify it, or share it with your girlfriends and family, whether you invest with Ellevest or not. And, while many traditional advisors charge upwards of $1,000 for a financial plan. Ellevest is working to close the gender investing gap, so they charge nothing for theirs.

And, while you might think you need the fortune to invest, companies like Ellevest, allow you to get started with as little as $5. Get started here.*

The Bottom Line:

Although there are risks that come with investing your money, there is also the potential for rewards — namely, helping you grow your money so you can meet your financial goals faster than if you had, say, put your money away in a basic savings account. So start today, even if you put away 2% of your income into a 401(k) or an IRA. Your future self will thank you.

Want more financial advice? Follow us on Twitter.

For when you don’t have a retirement fund…

Don’t sound the alarm – yet. Ellevest can get you set up in less than 10 minutes so you can reach all of your money goals. Sans judgment, finance jargon, and trust issues. Crisis averted. Get into it here.*

In search of even more financial wisdom, here are more personal finance topics for you:

The One Money-Habit All Wildly Successful Women Share

How to Increase Your Chances of a Long, Healthy (and Wealthy!) Life

3 Reasons Why You Need a Roth IRA- Even If You Have a 401(k)

Questions? We’re here to help. Leave us a comment and we’ll get back to you!

Disclosures: We’re excited to be teaming up with the team at Ellevest to start this conversation about women and money. We may receive compensation if you become an Ellevest client.