Women have been driving change in the workplace and the home. But there are still key opportunities for continued growth, especially on the money front.

According to a recent report by Merrill Lynch, 41% of women say their biggest financial regret is not investing more. According to the report, the key barriers for women are: 60% cite a lack of knowledge and 34% cite confidence. “Women regret not investing more of their money and are looking for financial education and solutions that align with their values and priorities, as well as their bottom line,” the report states.

Money and Life:

If you’re like most women I know, you take real pride in making your own money. And you should… because you’ve literally earned it. But earning and saving aren’t the only things you should be doing. Investing can make a heck of a lot of sense for you, too. And I’m not just talking about your 401(k) (kudos to you if you’re contributing) or your IRA (another thumbs up) or even your Roth. I mean investing in you — building wealth starting today so Future You can have the retirement of your daydreams.

Sure, investing can be a little scary (most of us hear about the market fluctuations), but it’s important to remember this is a long game, we’re talking 35-40 years! And if you don’t invest, and just keep your cash under the mattress (or, you know, in a savings account), in the long run, you’ll be losing money. In fact, you could be missing out on $100 a day by waiting to invest. Every. Single. Day.

That’s a fact.

In order to build real wealth, you will need to invest your money over time. The good news: investing is not that scary. You don’t need to be rich to start. And, you certainly do not need to know a whole lot about the stock market to make good investments, especially when there are robo-advisors with algorithms tailored specifically to women’s incomes and life cycles that can help. So what is investing, how do you do it, and, most importantly, why does it even matter?

Keep reading to get the full scoop on why you need to start investing, including what you can do to get started today.

Look at the Numbers

Did you know that historically your money doubles in the market every eight to 10 years? That may not sound like a good deal but stick with us for a second — let’s look at the numbers. If you wanted to save $1,000,000 by the time you retired (assuming retirement is 35 years away) you’d need to save $2,380 each month. But if you wanted to invest your way to a million dollars, you’d only need to save $491 a month. It’s not magic or bogus, it’s compounding. Einstein called compounding the eighth wonder of the world, and we couldn’t agree more.

Start Investing with Small Amounts of Money

Investing your money is an important way of helping you accomplish your specific, real-life financial goals. Whether you are looking to buy your first home, go back to school, start a family, or just grow your overall wealth, investing is arguably the best way to reach those goals.

When I started working my first part-time job, a good uncle encouraged me to open an investment account with a robo-advisor. I took his advice and set up an automatic contribution of just $30 per month. That’s $1 per day. If you’re reading this you can find a way to come up with $1 per day. No matter how small you start, the most important thing is to get started. You can always increase the amount you save over time. I’m saving way more than $30 per month now. But, the idea is to start.

The sooner you get started the easier it will be to get on track for your financial goals, whatever they may be. Even if you have to start small, get started. You may not be rich yet, but you will never be if you don’t get stat investing.

Put Yourself on Autopilot

As I mentioned earlier, automation is the easiest way to save. When you choose how much to put toward your 401(k) — whether it’s a dollar amount or a percentage of your pay — the money goes into your account before it’s taxed and before you even get a chance to think about spending it. You can replicate that process for an IRA and other investment accounts by setting up automatic monthly payments through your bank. Doing this removes the temptation of spending instead of saving.

This is how most of Ellevest’s clients invest.

Get Your 401k Match at Bare Minimum

The first place you should save for retirement is your employer-sponsored 401(k) plan. This money comes directly out of your paycheck before it hits your bank account, so you may hardly notice. You will seriously end up wanting to kick yourself if you get your full company matches each and every year. An employer match is like a raise without doing any extra work and can range from two percent to sometimes as high as 15% of your annual salary depending on your employer. A huge advantage here is the money comes to you pre-tax and, depending on your age and how you invest, could turn into a substantial amount of money later in life. It’s basically free money to you. You’d have to be crazy not to do everything in your power to get every single cent of it each and every year.

If you’re already investing in your company 401(k), good for you. An important question to ask yourself now is “How am I investing?” If you’re looking for help, our friends over at Ellevest will give you (complimentary) recommendations on how to allocate your “outside” retirement accounts, so you can get a more comprehensive investment approach and the best chance for success.

Have one or multips 401(k)’s or 403(b)’s from previous jobs? Roll them over into one place: your Ellevest retirement account.

Open an IRA

The next step for saving for retirement is an Individual Retirement Account — aka, an IRA. Anyone with earned income can open an IRA. That’s great news, especially if you’re self-employed, or work at a place without a 401(k) plan. Once you open an IRA, it stays in the same place, even when you switch jobs; it’s not housed with your employer.

Here are your IRA options: There’s the traditional IRA, Roth IRA (which comes with income limits), and — if you’re a literal boss and are self-employed — you may want to open a Simplified Employee Pension IRA (SEP-IRA).

Roth vs. Traditional IRA: What You Need to Know

You’ve now made it through the whole 401(k) vs. IRA decision Nice work — that dream retirement is looking a lot more real. Next up: deciding whether you want to use a traditional IRA or a Roth IRA (or both). Here’s what you need to know.

First things first: Not everyone’s eligible to Roth it up. Before we go any further, there’s one big thing you need to know: Not everybody’s eligible to contribute to a Roth IRA. There are income limits. So if your modified adjusted gross income (MAGI) is over $135,000 as a single filer (or $199,000 as a married couple filing jointly), then the whole “Roth vs. traditional” question won’t even apply to you. (In which case, maybe it’s time to upgrade your old IRA … you know, just saying.) Learn more and talk to a financial advisor today. No strings attached.

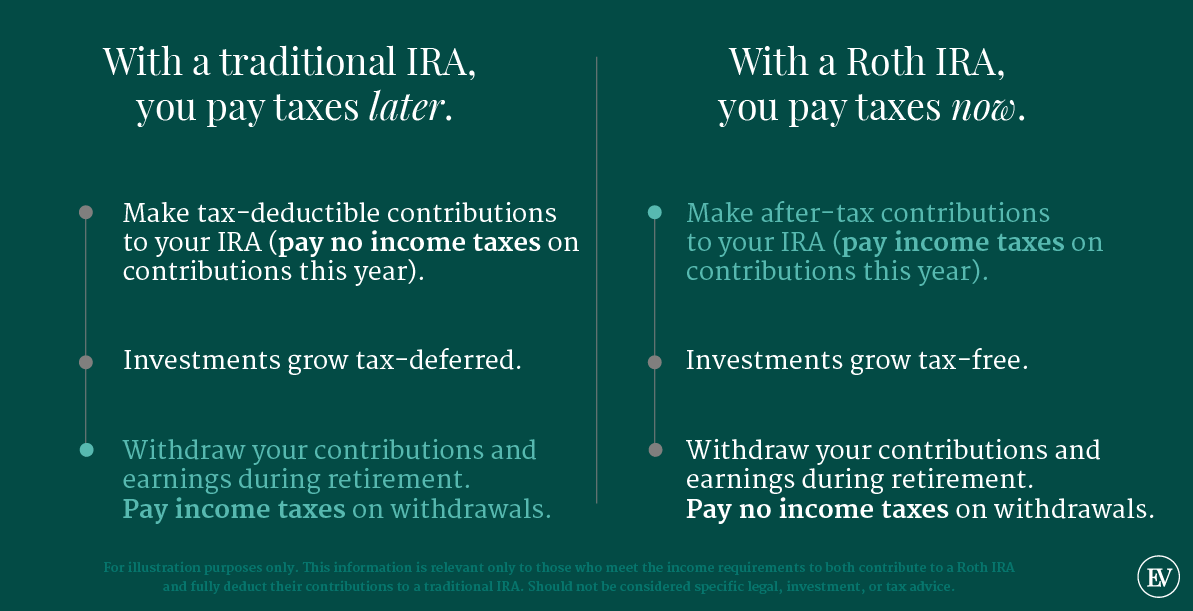

The basic rule with IRAs is you’re going to pay the US government taxes at some point. The question here is when you pay them. With a traditional retirement account, you pay taxes later. With a Roth retirement account, you pay taxes now. So if you think you’ll be in a lower tax bracket when you retire, you might choose a traditional, and if you think you’ll be in a higher tax bracket, you might choose a Roth.

Or, if you have no idea what’s going to happen in the future (what, did you misplace your crystal ball or something?), you might decide to hedge your bets and do a little bit of both according to Ellevest.

Still not sure which is right for you? Here’s a breakdown of the main ways a traditional IRA and a Roth IRA are similar and different.

How traditional and Roth IRAs are the same

Both traditional and Roth IRAs are retirement accounts with sweet tax benefits. Both allow your contributions to grow tax-free (aka you don’t pay taxes on capital gains, dividends, or interest). And, as long as you’re under the income limits, both allow you to contribute up to $5,500 a year ($6,500 if you’re over 50) — although that’s the limit total, not each. If you have both types of accounts, you can’t put $5,500 into one and $5,500 into the other.

How traditional and Roth IRAs are different

Income limits

There’s no income limit for a traditional IRA; anybody who has an income can open and contribute to one. And if you make under a certain amount, you might be able to deduct them on your taxes (more on that below).

For a Roth IRA, as mentioned above, you’re looking at limits. Single filers with a MAGI over $135,000 aren’t eligible to contribute to a Roth. If your MAGI is between $120,000 and $134,999, you can contribute some, but not the full $5,500. But if your MAGI is under $120,000, you can contribute the full amount to a Roth IRA with no problem. (Married couples and heads of households have different thresholds.)

Age limits

Once you hit age 70½, you can’t put any more money into a traditional IRA. There’s no age limit for Roth IRAs, as long as you or your spouse are still working.

So … traditional? Roth? Both?

If you’re looking for straightforward guidance on which type of account to use, we have good news: When you create a retirement plan with Ellevest, they’ll use the info you give them about your income to see if you’re eligible for a Roth. Then, if you are, they estimate your retirement forecast with a Roth IRA versus a traditional IRA, and then recommend the account type with the higher forecast. (They use the tax brackets that exist today, but there’s always a chance the laws could change.)

Both traditional IRAs and Roth IRAs have their perks, and so it all comes down to your expectations for the future. Basically, if you end up in a higher tax bracket in retirement, you’d be better off with a Roth. And if you end up in a lower tax bracket, you’d be better off in a traditional.

And so, in the end, whichever one you choose is sort of a gamble. Even if you’re right about what will happen with your income, who’s to say that tax brackets will even be the same when you retire? The changes to the 2018 tax code already showed that reform is possible.

One way to try to hedge those bets is to use both account types at the same time. How you split your contributions between the two is up to you. You just can’t pass $5,500 ($6,500 if you’re over 50) in total. And it’s a good idea to talk to a tax pro to really understand what’s right for you.

Whichever account type (or types) you decide to go with, one thing is for sure: When it comes to investing for retirement, the most important thing is that you do it — often and regularly.

Let Compounding Interest Work its Magic

Start investing now. The earlier you start the better. So what is compound interest? You’ve probably heard this buzzword in more place than one. In the simplest meaning of the phrase, it means “interest on the interest” and is the reason many investors are so successful.

Here’s an example of compound interest at work: saving just $100 per month, from 22 to 67, equates to approximately $1,048,000 provided you earn 10% growth per year. Waiting until you’re 32 years old to get started will cause that number to drop to $379,000. As you can see, waiting 10 years will result in a loss of about 64% of your retirement nest egg, all else being equal. (Ok, maybe you shouldn’t expect to earn 10% a year. The point still holds. At a 7% annual return, you’ll have about $379,000 if you get started at 22, but just around $180,00 if you wait until 32.)

Invest Your Money with Ellevest

Sallie Krawcheck founded Ellevest with the specific goal of closing the aforementioned investing gender gap. The company aims to serve women’s needs better than any other existing system by using an algorithm tailored specifically to women’s incomes and life cycles. (Yes, no one else has thought to do this before,)

The platform is well-designed, easy-to-use, and speaks to our unique financial needs — whether that be planning for retirement, that Aussie vacation, or starting a family. The best part? The advisors at Ellevest are incredibly knowledgeable and will help you every step of the way. Another big bonus? Ellevest has no minimum so you can start with as little as $5 today.

More important than money to is the autonomy to live your life on your own terms — and money can help. Get started today.

This is a lot of information to take in, but take it one step at a time. Trust your gut; do your research. And choose what’s right for you. You’ve got this.

Here are more personal finance topics for you…

The One Money-Habit All Wildly Successful Women Share

The Personal Finance Tips Everyone In Their 20s Should Follow

Finally: A Breakdown of How You Should Be Spending Your Money

Questions? We’re here to help. Leave us a comment and we’ll get back to you!