Women aren’t keeping quiet about the injustices we face every single day, and over the last year, we’ve also taken more action against them. This especially rings true for millennial women, who are eager to support causes that help further advance society and give back to those who need it most.

So you can imagine my excitement when Sallie Krawcheck, CEO of Ellevest, a digital investing platform made by and for women, announced a new kind of investment portfolio that not only helps you reach your biggest goals—buying a home, taking that big Aussie vacation, starting a family—but helps other women support theirs too. Sitting onstage with women like Michelle Obama and #MeToo founder Tarana Burke at the United State of Women Summit this past weekend, Krawcheck unveiled the Disrupt Money campaign in an effort to change the conversations that women have about money.

It’s time to level the playing field for women. Together. Here’s how we do it.

Money is power — live-the-life-I-want power, get-your-hand-off-my-leg power, start-my-dream-business power. And we women have been on the outside looking in.

Enough. Nothing is going to change until we change something.

Let’s Disrupt Money

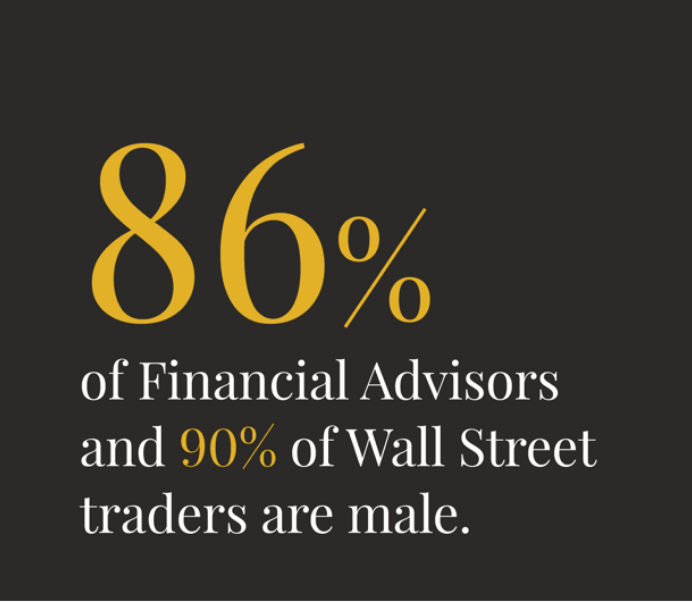

Think about the last conversation you had about money (and no, I don’t mean all of the time you said you wished you had more of it). Yeah, it’s hard for me too. That’s because women have been led to believe time and time again that money isn’t a womanly topic, and investing is especially a man’s world. There’s even research to back it up: Fidelity found that a whopping eight out of ten women remain tight-lipped about money matters when talking to their close friends and family.

Yet I’m willing to bet that all of your biggest goals, like wanting to start your own business, or buying a house, or traveling to every Instragrammable part of the Earth possible, could all be achievable if you just had a little extra pocket change.

Money truly is power, and that’s exactly the point that Ellevest’s Disrupt Money campaign wants to drive home.

We’re Making up for Lost Time

You see, the much talked about wage gap is estimated to close in 38 years—but only for white women. For black women, it’ll take about 106 years, and it’ll take 230 years for Latina women. What else? Women only make up 6% of the Fortune 500’s CEOs. If that isn’t infuriating enough, women-led companies actually perform better than those run by men. So it’s not that it’s an issue of incompetence, it’s a severe lack of opportunity. By completely changing the way to talk and feel about money, we’ll begin to create the opportunities we and other women have deserved for so long.

It’s Now or Never

It’s time that we start those long overdue conversations about money, and it’s also time that we start taking action to secure our financial freedom. We can start doing this for ourselves by negotiating for every new opportunity at work, every raise, and every promotion at work, as well as advocating for equal pay at our workplaces in general.

Oh, and here’s the big one: we’ll start investing.

Because, contrary to popular belief, investing is something that women are proven to be better at than men. Ellevest specifically takes into account the fact that women live longer and take more career breaks when building your investing plans, so you know you have someone who understands exactly how your money works and what you want to save it for. Best of all, it only takes minutes to speak with a team member at Ellevest to get started on your portfolio today.

With Ellevest’s new Impact Portfolios, you have the ability to not only save up for your biggest goals but to also help companies that advance women’s interests.

How?

Up to half of your portfolio will be made up of companies that are specifically committed to social change and women’s advancement. Best of all? Ellevest is giving you $100 when you invest in Impact Portfolios. Talk about a win-win-win.

It’s time we all step up and do our part to not only honor our goals but to honor to goals of all women who are working hard across the globe.

So, once again… Invest. Invest. Invest.

“When you invest, you give yourself the opportunity to earn more money than what you’d likely get from keeping your money in a barely-earning-interest savings account. That could mean a better retirement. A nicer house. A bigger F-Off Fund,” says Krawcheck.

Repeat after me: “We will start talking about money. We’ll ask for more money, we’ll save more money, we’ll invest more money, and we’ll give ourselves the opportunities we deserve.”

Money is power. It’s way past time that we got ours.

You in?