Ah life. It can get distracting. There’s work, relationships, exercising, side-hustling, personal interests, and hopefully some sleeping

If somehow “organizing your money” didn’t rank at the top-of-priorities last year, roger that.

Why?

Because, this one “to-do” is important—if not more important—than all the others. And, at some point, we all just need to buckle down and tackle it.

But “really, really important” doesn’t have to mean “really, really confusing” or “really, really hard to do.” In fact, I’m happy to report that organizing your money isn’t hard at all. In fact, budgeting, saving, and ramping up your planning and investing for retirement in 2019 can be a lot easier than you think.

Here, our partner Ellevest—an easy online investing tool that uses algorithms tailored to your salary, gender, and lifespan (aka your real life) shares some tips for how to stop procrastinating and start organizing our personal finances better today.

Let’s get started.

1. Stick to a budget.

First, take out your monthly bank statements and divide your after-tax income among needs, wants, savings and debt repayment, using the 50/30/20 budget as a guide. It’s a high-level, flexible budgeting framework that can help you control where your money’s going without having to count every penny.

- 50% of your income should go to living expenses and essentials. This includes your rent, utilities, and things like groceries and – transportation for work.

- 30% of your income should be used for flexible spending. This is everything you buy that you want but don’t necessarily need (like money spent on movies and travel).

- 20% of your income should go to financial goals, meaning your savings, investments, and debt-reduction payments (if you have debt, such as credit card payments).

Don’t think you have enough money to invest 20 percent? That’s OK. With a Robo-advisor like Ellevest, there’s no minimum to get started, so you can start wherever you are. (Seriously — start with $1, $5, or $500 … all good.) Future You will thank you for getting started today.

The goal is to eventually be setting aside 20% of every paycheck to Future You. Follow this rule of thumb, says founder of Ellevest, Sallie Krawcheck, and you’ll be set for financial success over the course of your life.

In a planning mood? See how an investment plan could help you manage your finances.You can get a personalized portfolio in under 10 min. And it’s made by women, for women.

2. Set your money goals.

Wondering what your money goals should even be at your age? You’re not alone. Check out Ellevest’s roundup of the money moves to make in your 20s.

Investing isn’t just for retirement. Making smaller, more flexible investments can help you connect to everyday short-term goals like starting a family or paying off debt or buying a house.

At Ellevest, they’re all about getting you to realize your biggest goals — whether that be planning for retirement, saving for that Aussie vacation, or starting a family. So with Ellevest, you’ll hear the phrase “goals-based investing.” Basically, what this means is that their investment objective is to help you reach your goals. That’s very different from trying to outperform some market index. Makes sense. Doesn’t it?

3. Pay down debt.

If you want to start paying down your debt, you’ll need a game plan. Here’s the explainer on the difference between “good debt” and “bad debt.” Here’s the lowdown on student loan debt and a game plan for tackling it.

4. Build a cushion for emergencies.

If you want to build up an emergency fund, great news — Ellevest has a goal for that. Here’s how much you need to save and what you should do with those savings. Don’t have an emergency fund set up yet? Ellevest can help you set one up for free and help you reach all of your money goals. Sans judgment, finance jargon, and trust issues. Get into it here.*

Ready to open your investing account? Follow the link below and you’ll be taken to Ellevest for more information.

⇒ Get Started Investing With Ellevest

5. Don’t play the market.

Buy low! Sell high! We’ve all heard those not-so-useful investing clichés, usually in cartoonish depictions of Wall Street. While market timing — knowing when the market will be “low” or “high” — is considered to be the holy grail of investing, timing the marketing is nearly impossible to do for the average person. Very, very, very few people can time the market well, and even fewer can do it consistently. Instead, regular investing over time in every type of market climate is the best way to “play” the long game.

This leads us to the next rule…

6. Don’t wait to invest.

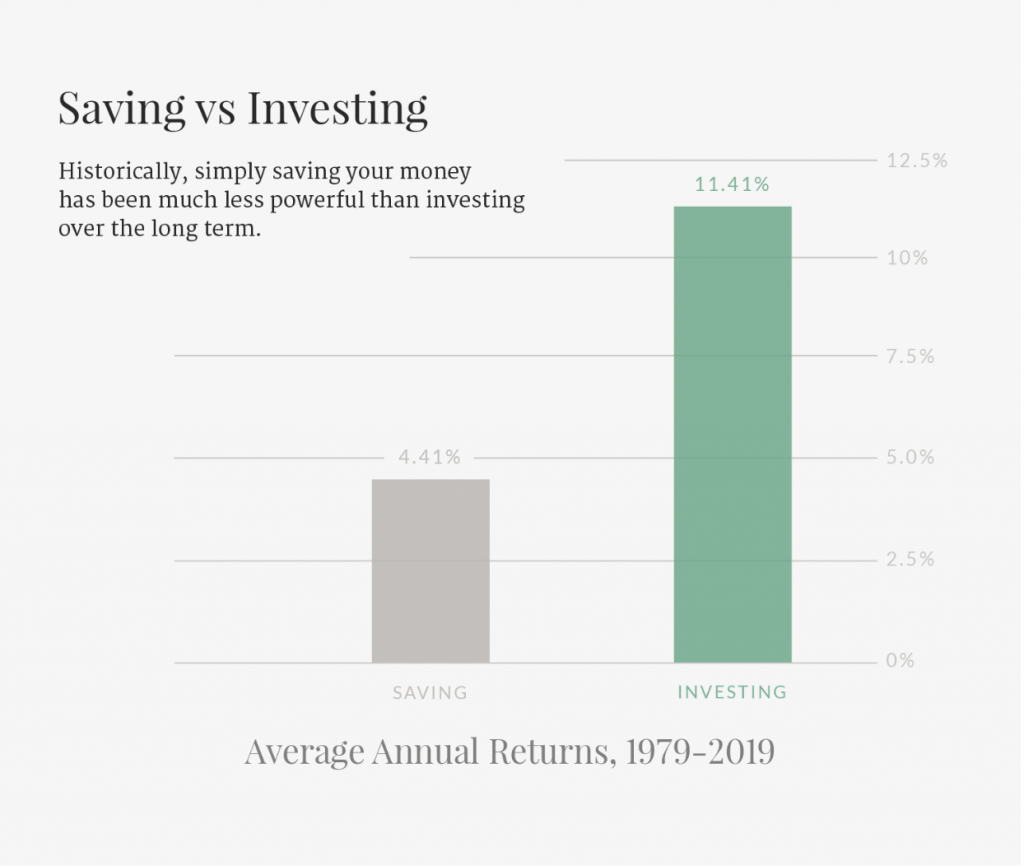

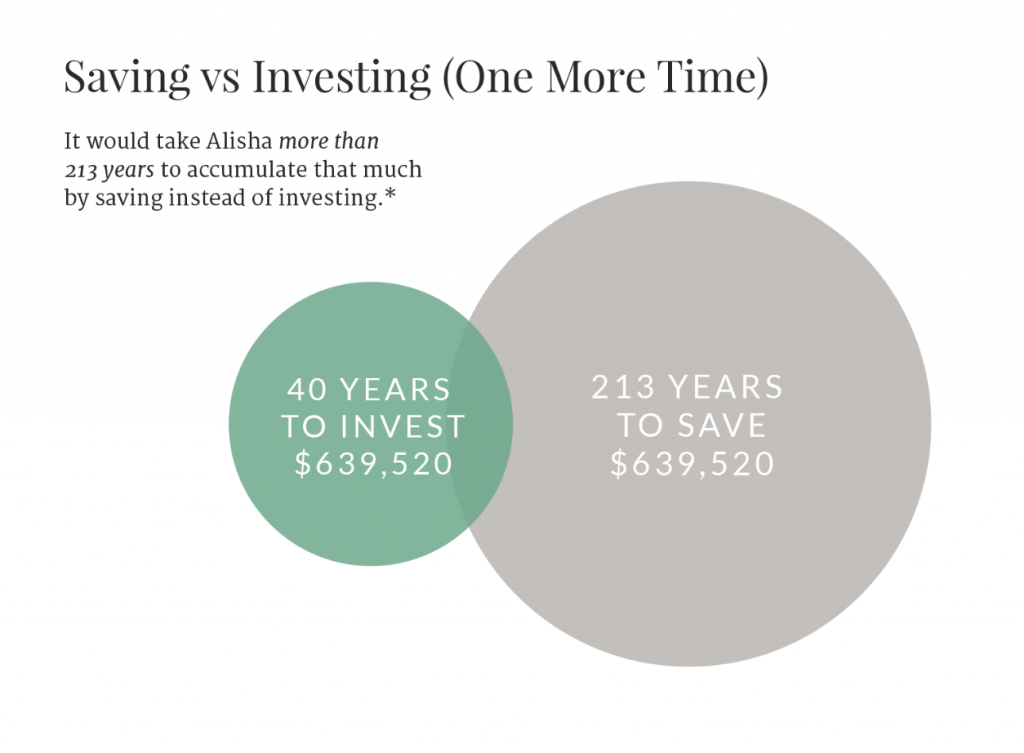

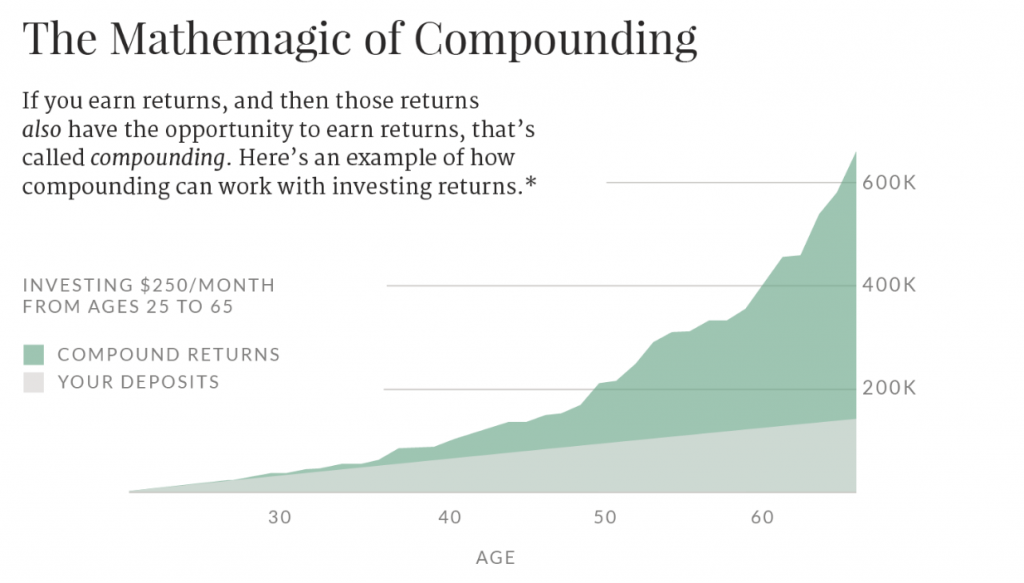

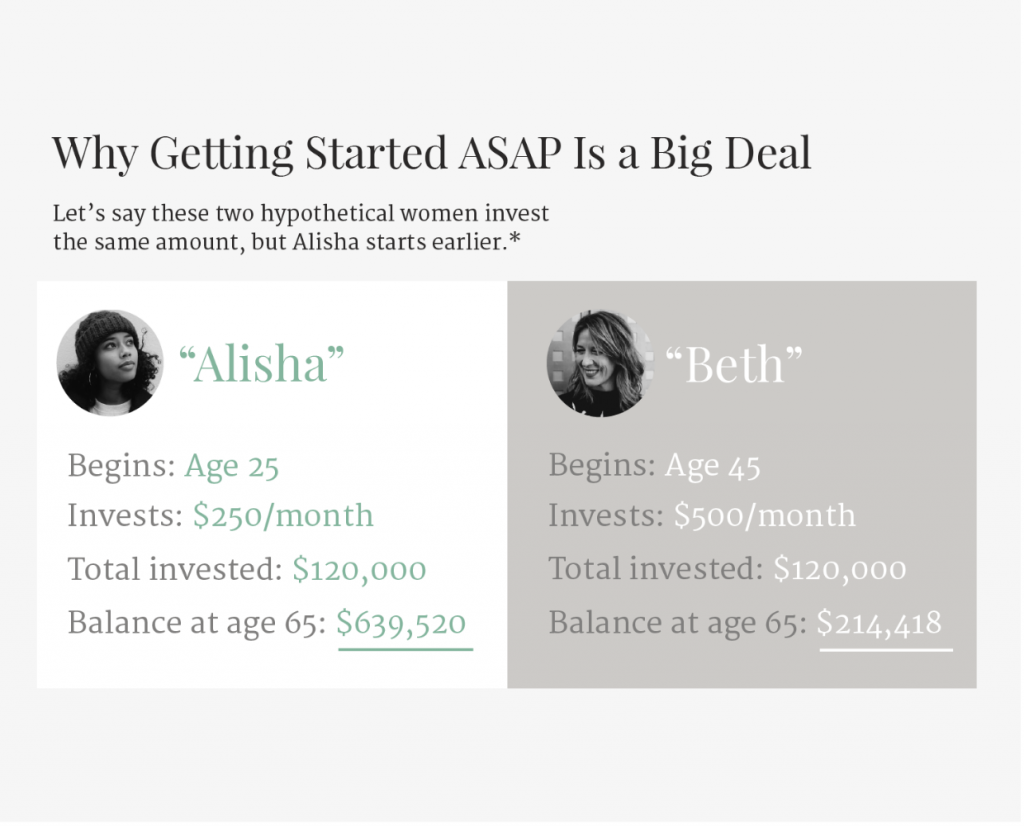

Contrary to popular belief, you can (and absolutely should) start investing before you have a lot of money. Investing small amounts of money and making a few small, smart investments (like taking advantage of a 401(k) employer match.) can have a huge impact over time.

So just do it, honestly. Being financially ready could be a lot closer than you think, and it’s the one gap you can start closing in minutes.

7. Make investing a habit.

And six, make investing a habit. Sure, it’s easy to wait, but make it a habit. Invest a little or a little more out of every paycheck, whatever works for you and your budget. And that’s why Ellevest has no minimum account size.

Don’t know where to start? We suggest starting with retirement. If you have a 401(k) employer match available to you, it’s in your best interest to take full advantage of that. Here’s how it works and why it’s important to take advantage of your 401(k) employer match.

And, if you have an old 401(k) or two from a past life just hanging out, don’t worry. It happens. There are a lot of moving variables when you get a new job, and it’s easy to let a former employer’s 401(k) get lost in the shuffle. The good news is that you can probably still roll it over — either into your current 401(k) or an IRA — even if it’s been hanging out for a while. Not sure what that involves? Here’s an explainer for you.

For when you don’t have a retirement fund…

Don’t sound the alarm – yet. Ellevest can get you set up in less than 10 minutes so you can reach all of your money goals. Sans judgment, finance jargon, and trust issues. Crisis, averted. Get into it here.*

In search of even more financial wisdom, here are more personal finance topics for you:

The One Money-Habit All Wildly Successful Women Share

How Saving $15 A Day Can Make You A Millionaire

3 Reasons Why You Need a Roth IRA- Even If You Have a 401(k)

Disclosures: We’re excited to be working with Ellevest to start this conversation about women and money. We receive compensation if you become an Ellevest client.