2017 was a year of awakening for women across the world, and therefore a perfect time to ask us about our outlook on the future.

Ellevest, a digital investment platform made with women in mind, recently released the results of its 2018 Census to gain insight on how women really feel about topics like money and confidence compared to their male counterparts.

The major takeaway?

The #1 thing that makes women feel in charge of their futures is “putting away money for financial goals.”

Taking positive action with their money is a huge confidence booster for the 1,000 women surveyed. The #1 thing that makes women feel in charge of their futures is “putting away money for financial goals,” followed by how much we save (#2) and how much we invest (#3). In fact, getting involved with our finances had a bigger positive impact and confidence boost on how in charge we feel about our future — even more than our educations (#8) and the support we get from our families (spouse/partner, family/parents and even being a mother or a father) (#6, #9, #10).

That’s right: it wasn’t our salaries, levels of education, or the health of the economy, but saving and investing the money we make.

If there was one good thing to come out of the 2016 election, it has been convincing women to take control of their own finances through investing, since [we] have actually been both talking about it and doing more of it since then. In this way, according to the research: women are just like men.

But, then: (there’s that “but”), the issue is we don’t realize how much we’re missing out by not taking control of our financial futures today. For far too long — and even today — [we] women simply are not investing — and therefore we’re losing out on a lot of money — and we mean a lot.

The opportunities in money being left on the table are what Ellevest calls: women’s blind spot. And this blind spot can be very (very) expensive, especially when it comes to not investing. Nearly half the womenEllevest surveyed weren’t aware that, besides the wage gap, there’s also an investing gap, where men invest more than women. We’re so used to thinking that investing is something men do and do better. (Not true). Females’ investing habits are every bit as good as males’ — actually, better — yup, this is data too, and the effect of not investing can really cost us — big time.

So, how much are we talking here? Ellevest asked the women who did know about the investing gap what they thought this gap might cost them over a lifetime — and the difference between their way too-low estimates and the projected cost is shocking.

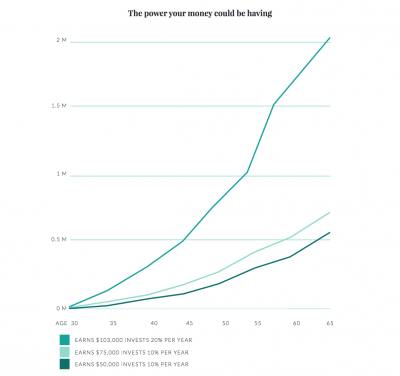

Here’s the truth: For women earning $50,000 to $70,000 a year, the projected individual cost of the investing gap starts in the hundreds of thousands. And for the average woman in the survey, whose salary was just over $100,000, the cost of the investment gap came out to more than $1 million — or 10 times their estimate.**

Let’s take for example: if your salary is $85,000 and you simply save 20% of it instead of investing it, you’re actually missing out on $1.1 million or even more over the next 40 years. Put another way, you’re losing $100 a day by not investing it.

Bottom line: Investing is a powerful tool to help you save up for your biggest goals and wildest dreams, and that’s precisely how your money is your power. There’s no need to deny yourself the money — and confidence boost —that you absolutely deserve.

Sure, we’re risk-averse. But don’t conflate investing with gambling your money in a Las Vegas casino. An Ellevest portfolio, for example, gives you a diverse array of low-risk ETFs so that you don’t feel like you’re betting your money on one thing — or you can lose it all in one shot. Don’t worry about wading through pages of complex financial jargon, either. If you invest with Ellevest, it means having a support team in place so you can keep your eye on the prize, be it a dream vacation, buy a home, or opening up your own business.

Oh, and what about the 1,000 men that Ellevest surveyed in its 2018 Census? While they’re happier with their financial statuses, they don’t see gender inequality the way that women do. So why would you trust your money with one of those boys? Ellevest takes into consideration the unique challenges that [we] face, like more frequent career breaks, salary peaks, and longer life expectancy, to generate realistic portfolios to make your money work for you.

Because if you’re going to live longer, you’ll need more money: amirite?

And the one who needs to be in charge of your money is YOU. Just you. Right now. If you’ve outsourced it to someone else in your life, you need to be massively involved: they don’t call them individual retirement accounts for anything.

A few thoughts to — from us here at Style Salute — to motivate you to invest in fabulous Future You: