Is it possible that you’re spending more on your morning joe than saving for retirement? According to a new study conducted by SurveyMonkey for investing app Acorns, the answer is likely yes. A staggering 1 out of every 3 Millennials spends more money on coffee than they spend saving for retirement. Especially, it turns out, women.

This is really, really bad for a generation of women which prides itself on individuality and power. That’s why it’s one of our goals here at Style Salute to help you get a jumpstart on saving for retirement and to take action to be in greater control of your money.

Sure, retirement planning can be an overwhelming topic for everyone — we get it — it’s not fun. And worse, it’s confusing. But that should not be an excuse to not contribute. And yeah, it’s not the same instant buzz as an iced caramel macchiato, but with some strategic planning, you can save for retirement and have fun.

So, Why even care about retirement right now? Priya Malani, the money-savvy co-founder of Stash Wealth, suggests the sooner you start planning for retirement, the more time you’ll give your money to grow. This is because your money is more valuable in your twenties than any other time. According to Malani, every dollar you save in your twenties will be worth around $16 in retirement whereas every dollar you save in your thirties will be worth around $8 in retirement. You don’t need to be a financial expert to know that that’s a lot of money to lose out on if you don’t act now.

So, with your money worth more now than in the future (think of it as a reverse fine wine), it’s probably a good time to put some thought into how you’re saving for retirement. Think about it: If you can start being as free with your investment money as you are with your daily coffee budget, you can be looking at a nice cushion of money in just a matter of a few years.

A lot of people, particularly women, make the mistake of putting off retirement planning. Maybe you’re confused by the process, or you think you don’t know enough yet or have enough money yet to get started. But every day that you’re not investing that money, it can cost you money. Have questions? You may have an employer-sponsored 401(k), but is that enough? Should you have another retirement account like a Roth IRA on top of your company account? What if you’re a freelancer? What the hell is matching? And why do my eyes glaze over every time I try to read an article about the right way to save for retirement? Don’t fret, I got you.

Here’s what you need to know about saving for retirement, including what to do if you haven’t started.

The Retirement Crisis is A Women’s Crisis

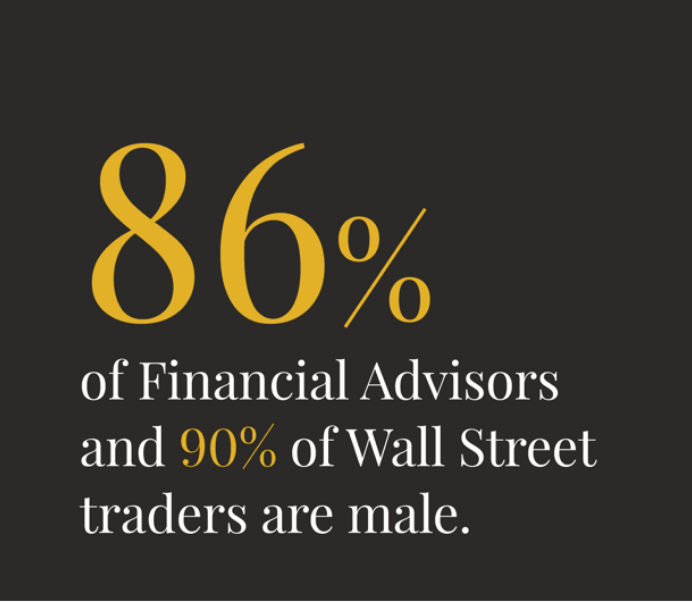

Sorry to be the messenger here, but when it comes to retirement, we women are far worse off than men. The gender retirement-gap may be less well-known than the gender pay gap, but it is a lot wider than the pay gap. The fact is we women retire with two-thirds the savings of men, live six to ten years longer and as a result of our longer lifespans, we have higher medical costs.

The good news is that it’s quite simple to develop a powerful retirement strategy now. Sallie Krawcheck, former president of wealth management at Bank of America spent years as one of the few females at the top of the financial industry, and now she is looking to change all that with the launch of Ellevest, a robo-advising platform designed specifically for women.

Ellevest factors women’s generally lower incomes, different lifetime earnings curve, and longer lifespan into portfolio construction. Another notable feature is Ellevest’s additional planning layer, which helps clients achieve short-term financial goals — e.g., amassing an emergency fund, saving for a home — in addition to long-term financial security. Taking action to be in greater control of your money, and saving for retirement can help us spend more time focused on work, rather than focused on not having money.

Try it now: Be a woman with a plan. Invest with Ellevest in Under 10 Minutes. Simply, head to the Ellevest website, tell them about yourself and your life goals in 5 short steps, and they’ll suggest personalized investment portfolios based on your goals.

Understand These 6 Types of Investments and You’ll Be a Pro

Now that I’ve covered why preparing for your retirement is so important, it’s time to go over which types of retirement accounts exist, and which one(s) are best for you.

One thing to know for sure. Retirement planning is different for everyone. There’s no one-size-fits-all account for retirement savings. Different options are out there depending on your individual financial situation.

Ready to expand your portfolio? Scroll down for our breakdown of these six types of investments.

If you have access to either one of these types of accounts, great! An employer-sponsored account is a great place to start saving up for your retirement. Choose how much you want to invest and the amount will be deducted from each paycheck. You can contribute a maximum of $18,500 to your 401k each year. If your employer offers a 401k match, take it! It’s basically free money.

Anyone can have an IRA, regardless of whether or not you have a 401k. You can contribute up to $5,500. With an IRA, you contribute your pre-tax earnings and you won’t be taxed on that money until you withdraw from your IRA. If you are a freelancer and aren’t covered by a workplace retirement plan, you may even have a completely tax-deductible IRA. In plain English, that means that you won’t be a tax liability and therefore will have more money to invest in your future.

One caveat, though: if you’ve moved into a higher income bracket by the time you do come around to withdrawing your money, or if the government raises tax rates in the future, you could end up paying more taxes.

With a Roth IRA, you’ll pay taxes on what you contribute automatically. So while you don’t have a reduced tax liability, you won’t have to worry about paying taxes on whatever you withdraw in the future. Roth IRAs do come with income requirements. Many people have both a traditional IRA and a Roth IRA if they aren’t sure how they’re future is looking (e.g. whether or not they’ll move into a higher income bracket). Malani says that opening a Roth IRA is the best thing to do if you don’t have an employer-sponsored 401k if you’re eligible. “For most millennials, setting up an automatic monthly transfer from your checking account to your Roth IRA is a great idea because if you plan to contribute to your Roth IRA manually, you’ll never do it!”

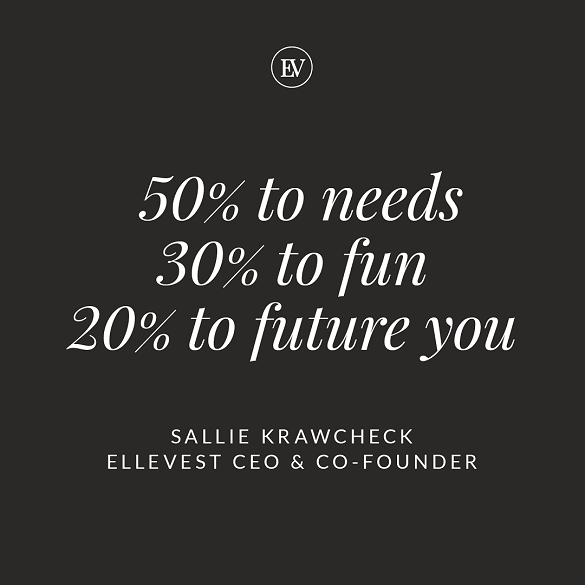

Malani’s advice is to “Try maxing your Roth IRA each year, which means a contribution of $458 per month. You could break that up into 2 monthly payments if you get paid twice a month. Make it easier to manage.”

You can set up your own 401k and contribute both as an employee and employer. As the name implies, this is the ideal plan for someone that works for herself, as you must be a business owner with no employees to be eligible for a Solo 401k. You can contribute up to $55,000 per year to your account.

This is another retirement account that is good for those that are self-employed or who own a small business. You can contribute up to 25% of your earnings or $55,000, whichever is the lesser amount.

The Simple IRA is designed for small businesses with fewer than 100 employees. You can contribute up to $12,500 in a simple IRA.

If you’re switching jobs, you can roll over your existing 401k to that of your new jobs or to another retirement account. Ellevest offers 401k rollovers so you can keep track of your retirement savings in one place, even if you’ve been job-hopping.

Why You Should Also Be Investing

Your employer-sponsored 401k may have limits as to what you can invest in, but with a Roth IRA or IRA, you can explore different investment options to grow your retirement accounts beyond just saving up to the limit. Remember, investing isn’t the same thing as gambling. It’s all about executing a smart strategy. “If you’re investing in a diversified portfolio, the only way to lose all your money would be if the entire world blew up and at that point, we’d have bigger problems to face,” says Malani.

That’s right, you don’t need to be rich to invest. In fact, even people who have loads of student debt and are seemingly scraping by can get a deal. Malani advises setting aside at least 2% of your money for your 401k to ensure that you’re making any sort of contribution you can. This piece from The Muse does a great job breaking down what you need to do whether or not you are saving for your retirement yet.

Try it now: Ellevest is fiduciary, and their number one goal (24/7/365) is making investing a better experience for you. It’s that simple.

Get Help If You Need It

Does all of this sound a little…confusing? Don’t worry, everyone else thinks so too. Work with an experienced financial planner that understands your unique needs and desires. For example, Stash works primarily with what they call H.E.N.R.Ys™ (or, “High Earners, Not Rich Yet”), or individuals and couples that have earning potentials in the six figures, and Ellevest’s algorithm takes into account women’s tendency to live longer and take more career breaks.

If you’re pressed for time and don’t think you can commit to investing, you’d be surprised by how little effort it takes to maintain a solid portfolio. In fact, when you have a diversified portfolio, the best thing to do is to sit back and relax. That’s just what Malani and her team advise their clients to do this at Stash. She says, “If you invest in a diversified portfolio, it should require little to no time commitment, once your automation is set up. When investing, you should keep a mid-to-long-term perspective in mind and don’t meddle with your investments. Thinking you’re supposed to do something is the enemy of proper long-term investing.” Sounds good to us!

Like Stash, it only takes a few minutes to set up a financial plan with Ellevest. From there, the team will be on hand to answer any questions you may have and guide you through the entire investment process. The goal is to always set you up for success.

Researching options for your retirement accounts may not be the most exciting thing in the world, but think about how much benefit you’ll reap just by setting up a portfolio and watching your money grow.

What are you waiting for? It only takes a few minutes to set up an account. Plus, Ellevest has no minimum so you can start investing with as little, or as much as you like.