Not to be dramatic, but my life has not been the same since I bought this Badger Sleep Balm. It’s nut, but somehow wearing this lip balm has helped me get better sleep and fall asleep faster.

And it’s not just me. You’ve probably noticed that Amazon shoppers love to leave reviews, with some items racking them up. That said, this products glowing reviews say it all. Many of the reviews on Amazon for other products can be vague (or even fake), so I loved that the reviews for this product were spot on about the quality, and use. Here’s one:

“I’ve suffered with sleep problems for years, whether it’s an inability to sleep or chronic nightmares, I’ve been there. Melatonin made me groggy if I didn’t get a full 8 hours and gave me nightmares. Valerian Root made me sleep too deeply, causing me to oversleep my alarms. What I like about this is that it doesn’t put you to sleep, but instead relaxes the mind. I put some on my neck and on the arches on the bottom of my feet and I’m relaxed within minutes and most likely already asleep, but it allows me to awake if the phone rings or anything of that nature. It’s also not a greasy formula, so it doesn’t get all over the sheets. I’d recommend this for anyone who likes sleep.”

With over 500 positive reviews, this lip balm will be your new go-to. Made of all natural ingredients and free of any yucky artificial ingredients, it’s safe to generously apply on your lips every night. I even like dabbing it under my nose and on my temples. How what is on our lips triggers us to fall asleep, we have no idea. But, if it helps us get our much need beauty sleep, we are so in.

Scroll through to add Badger Sleep Balm to your shopping cart, plus check out a few more of our favorite sleep aides.

I Overspent This Holiday—Here’s How I’m Saving (And Still Living My Life)

I’m at an age where I’ve started taking my finances more seriously. I don’t tend to indulge in unnecessary spending and I take great pride in my monetary restraint. But that all goes out the window as soon as winter approaches. It’s almost comical how one of the most joyful times of the year causes so much stress. Between the gift buying, traveling, hosting, food and décor, my poor wallet sits there and weeps.

But here’s the thing: I never intend to overspend. I set myself a budget well in advance but I somehow always end up blowing it. There’s just all this pressure that I’ve built up in my head to find the perfect outfit or gift and there’s always some kind of last-minute shopping that needs to be done. It also doesn’t help when retailers lure me in with their nifty markdowns and generous discount codes. My self-control is truly pitiful. Soon enough, every little thing starts adding up and I can feel myself drowning in remorse when I log in to my bank account.

And I’m not the only one. More than three-quarters of consumers overspend on holiday purchases, according to TD Bank’s 2017 Merry Money Survey. And it’s not just overspending by $5 or $10. The average American spends at least $263 more than expected.

If you’re anything like me, getting your finances under control after the holidays might seem like a mammoth of a task, but it’s not impossible. It all comes down to fostering a cognisant relationship with your spending habits and your earnings, which takes time, discipline, and budgeting. I’ve learned that it’s all a matter of progress and it’s a paradigm of mind over matter.

With the much–needed help of personal finance pros, I’ve begun to prioritize my expenditure in such a way that I can now continue saving for my future. The best part is, I don’t feel like I need to compromise on having fun.

Keep reading to discover how exactly I’m doing it.

Assess the Situation

Before you do anything, take some time to evaluate why you might have overspent in the first place. Knowing this is crucial because you can prevent it from happening again. Print out your bank statement and sift through any receipts to determine where you may have gone overboard. It’s a good idea to jot down all your holiday-related expenses so that you can plan your budget more effectively for next time. It’s a learning curve and proactively assessing your outgoings is a positive first step.

Go Back to Budgeting

Having a budget is a great way to keep track of your finances. I used to be rubbish at budgeting, but I’ve found that the 50-20-30 rule really works for me and it’s easy to implement. As per this rule, fifty percent of my monthly income covers basic needs, like food and rent. Twenty percent goes to my future savings. And thirty percent is for fun.

Holidays are an expensive time of the year, so don’t be too hard on yourself if you spent more than you hoped. Just tweak the percentages to compensate for the extra expenditure. This might mean forfeiting that take-out coffee or those boots you had your eye on to ensure you have enough money to pay for less flexible expenses like your bills. It’ll beat having to take out a loan!

Take Care of Any Debt

Paying off debt is just as important as investing for the future and it can be hard to prioritize one over the other. However, since we’re trying to regain our financial footing, it’s wise to eliminate any “bad debt”, such as credit card debt, before it snowballs. To do so, you’ll need to craft a cohesive repayment plan that’ll replenish your savings in due time. You can also look into transferring your credit card balances to a 0% interest card which might speed up the process.

Or better yet, avoid using your credit cards altogether. I find that taking them out of my wallet reduces any temptation. After all, out of sight, out of mind.

Consider Your Payment Options

There’s just something about physical, paper cash that makes me far more conscious about what I’m spending. I can confirm that the psychological influence is real. Using cash is a great way to be more mindful of your outgoings which in turn will help you stick to your budget. Before switching, it’s best to figure out which areas of your overall expenditure are better suited to this type of payment.

Personally, I’ve started reserving cash for groceries and clothes since I know I overspend on these things. Remember, forgo the credit card if you don’t think you’ll be able to pay off the balance in full each month.

Freeze Any Frivolous Spending

If you’ve really gone to town with your expenses this year, maybe it’s time to freeze any frivolous spending for a few days. This is highly beneficial in theory but extremely challenging in practice. It takes major willpower, but it means that you’ll truly hit the reset button. There’s nothing like a little short-term pain for long-term gain.

If going cold turkey seems improbable, you can keep yourself from spending by investing. It’s a much better use of your money and your future self will thank you. At first, investing might seem scary. I for one found the whole concept overwhelming and I had no idea where to begin.

But I turned to Ellevest which has been a complete blessing for my fiscal well-being. Ellevest is a digital investing platform made by women, for women, that uses tailor-made algorithms for your lifestyle. It only took me 10 minutes to sign up and I didn’t even need a minimum investment or balance. So easy and I know I’m doing something good for my future.

Make Investing Automatic

The easiest way to save? Make it something you don’t even have to think about. If you’ve already set up an automatic savings account but want to do more for your future, robo advisors like Ellevest may be your answer.

Unlike your typical human financial advisor, robo-advisors are automated platforms that create tailored investment portfolios based on your financial goals and comfort level. These platforms make it really easy to invest online. They do the research for you, and if there’s a change in the market, the platforms automatically update to optimize portfolio performance. Genius.

Regardless of how you decide to invest, the habit of investing will likely benefit you in the long run. I know it’s scary to think about investing, especially if the market is volatile, but you have to remember: it’s important to not react to the market. When the market falls, your instinct might say to sell and cut your losses. If you do this, you will never give it the chance for it to go back up and ride that wave. In addition, similar to setting up your credit card on auto-pay, set up automatic investing every month. Investing isn’t a one and done kind of thing, and if it is automatic, you won’t even miss it.

Lastly, if you want to retire, you have to invest. Whether it is through your 401(k), IRA, or your own personal investment portfolio, you need money to work for you, rather than only you working for it. Get started today.

We hear from a lot of women that they think they need to be a financial expert before they get started investing. You don’t. You only really need to know five basic things. That’s right: Fives basic things before you get started. Here they are.

Here are more personal finance topics for you…

The One Money-Habit All Wildly Successful Women Share

The Personal Finance Tips Everyone In Their 20s Should Follow

3 Reasons Why You Need a Roth IRA- Even If You Have a 401(k)

The Secret to Looking Well Slept After a Long Flight

As a beauty editor, I’m a big fan of flying pretty much anywhere and whenever I get the chance. But the toll it takes on my skin is something I could live without.

Zero humidity, recycled oxygen, and chemicals everywhere can both dry out skin and cause more breakouts. Feeling dehydrated and oily just reading this? Us too. So instead of just dealing with “plane face,” we thought we’d share our in-flight skincare secrets.

Along with relaxing and catching up on your favorite magazine, try to look at air travel as an opportunity to beautify. For instance, Jessica Alba recently revealed that she never travels without her NURSE JAMIE Beauty Bear Age Delay Pillow ($69). The ultimate anti-wrinkle pillow for minimizing sleep lines and wrinkles while you sleep, the NURSE JAMIE Beauty Bear Age Delay Pillow allows your skin to retain its natural moisture and oils, helping to minimize the appearance and creation of deep-set sleep wrinkles.

Now, that’s beauty sleep.

So, go ahead fill up your carry-on bag packed with a mini-arsenal of travel-size anti-aging products and get ready for the most radiant skin ever—no matter how long your flight. Because nothing is more exciting than arriving at your destination with a well-rested, line-less and radiant skin.

Keep scrolling for our roundup of tried-and-true skin products for an on-the-go glow.

Use a Silk Pillowcase

Apply a Lip Balm with a Calming Scent

Not to be dramatic, but Amazon shoppers have shared that this sleep balm has changed their life.

Take a Sleep-Aid Supplement

Use a Facial Mask

Apply Eye Masks Before Landing

Karlie Kloss swears by these Klorane eye patches for better sleep on a flight.

Drink Plenty of Water

Massage Your Face to Minimize Puffiness

Next up: the buzzy $6 lip balm you need to try that will help you sleep better every night. Want more? You can also read this.

Answered: 401(k) vs. Roth IRA? Use Both If You Can

Which is best for me: A 401(k) or an IRA? If you’re asking yourself this question, then, you, my friend, are on the right track to saving for retirement. It’s okay to admit that 401(k)s and IRAs are confusing (they are confusing AF).

But, that’s not a good excuse not to save. Let’s get into it.

Where does one begin? During the investment process, certain questions are bound to pop up: Do I need a Roth IRA if I have a 401(k)? Which retirement account is best for me? And what funds should I invest in, anyway?

For some answers on 401Ks, as well as IRAs, keep reading.

Should I contribute to my employer’s 401(k)?

If your employer offers a retirement plan, like a 401(k) or 403(b), and will match a percentage of your contributions, and you’re not taking advantage of it, you’re essentially leaving money on the table that could make a big difference in a few decades because of compound growth.

After all, it’s free money for you.

Plus you’ll have a tax-deferred account that makes saving a cinch through automatic payroll deduction. The next stop for saving for retirement is an Individual Retirement Account — aka, an IRA.

What is an IRA and How Many Types of IRAs are There?

IRAs comes in three ways: There’s the traditional IRA, a Roth IRA (which comes with income limits), and — if you’re self-employed — you may want to open a Simplified Employee Pension IRA (SEP-IRA).

It sounds confusing, but the basic rule with IRAs is you’re going to pay the US government taxes at some point. The question is when. With a traditional IRA, the government postpones your taxes. You contribute pre-tax earnings, reduce your tax liability for the year, and watch that money grow on a tax-deferred basis year over year. You don’t pay the piper until you withdraw your money in retirement.

What Is a Roth IRA?

This particular type of retirement account was introduced in 1997 and created in Congress to allow individuals to save for retirement. Contributions to a Roth IRA are made with after-tax funds, and the assets grow tax-free. Unlike a Traditional IRA, withdrawals from a Roth IRA are usually tax-free. This is especially beneficial if you expect to accrue a significant amount of interest on your earnings over time, according to MyDomaine.

A Roth IRA is not offered through your employer, so you’ll have to set this account up yourself. The process of setting up an IRA with Ellevest is super simple. It’s all online: You can start your IRA within minutes, see (and adjust, if you want) your recommended Ellevest IRA portfolio, and then…just sign off on it and relax.

Who Can Get a Roth IRA?

While anyone can contribute to a Traditional IRA, eligibility for a Roth IRA is based on your income level. Pretty much anyone who has earned income is eligible for a Roth, as long as they don’t earn more than $131,000 if they’re filing individually or $193,000 if they’re filing jointly. If your employer offers you a 401(k), you can diversify and set up a Roth IRA in addition to that.

That’s great news, especially if you’re a freelancer, or work at a place without a 401(k) plan. Once you open an IRA, it stays in the same place, even when you switch jobs; it’s not housed with your employer. Pretty cool, right?

A nice bonus here: You can contribute up to $5500 a year (once you hit 50, you can invest an extra $1000 annually).

Eligible for Both? Get Both.

Contrary to what a lot of people think, you don’t necessarily have to think IRA versus 401(k). You can save with both as long as you’re qualified and meet contribution and income limits.

How Can I Set Up an IRA?

You can open an IRA at Ellevest, or at another financial services provider. Whether you go with a Traditional or Roth account, the bottom line is an IRA lets you add thousands of dollars a year to your retirement savings. In 2018, your total contributions to all of your traditional and Roth IRAs cannot be more than $5,500 ($6,500 if you’re age 50 or older).

Have multiple 401(k)’s and/or IRA’s? Not a problem. You can consolidate your multiple retirement accounts into one simple view with Ellevest digital. And the process of transferring your IRA to Ellevest is super easy. It’s all online: You can start your IRA transfer within minutes, see (and adjust, if you want) your recommended Ellevest IRA portfolio, and then…just sign off on it and relax.

Ellevest will reach out to your IRA provider to take care of the rest, and if they need additional information from you, they’ll get in touch. Also important: They won’t charge you any fees for bringing your IRA over to Ellevest, and you won’t be taxed for the IRA transfer either.

Why You Should Invest Like a Woman

Whether you’re sipping pína coladas in Hawaii or relaxing in the desert, you know you want to retire in style. And you deserve a retirement account designed to help you do just that.

That’s why our friends over at Ellevest have flipped retirement planning on its head, bringing you a totally different IRA — one that’s specifically built for women.

Wait, what?

Yes, for women — but not in the pink vs blue. There are gender-specific differences that impact our ability as women to save and what we’ll need to do to make our retirement the best long weekend ever. Some other financial advisors don’t recognize these differences, and your IRA might reflect that.

I mean… we’ve heard it all before. Men are from Mars; women are from Venus. A lot of these “differences” between genders are bull, but some gender-based differences do have a real impact when you’re planning for retirement. For instance, the fact that women, on average, outlive men, so our money needs to last for a longer retirement than men’s. Also, our salaries grow at different rates, so we need to be smarter about how much we save and when we do it.

So, as we said: We’re kind of over basic. If you are, too, you can transfer your traditional, Roth and SEP IRA(s) to Ellevest to get the personalized portfolio your bad-a$$ retirement deserves.

Ok, So What’s The Takeaway?

Next up: are you self-employed? You have retirement options too.

Disclosures: We’re excited to be partnering with Ellevest to start this conversation about women and money. We may receive compensation if you become an Ellevest client.

Overwhelmed? 4 Ways Being Less Busy Can Help You Achieve More

You’ve heard it from me before: Small changes can help transform your life. For me, I practice making these small changes every day. One small change I’m working on this month is how to be less busy so I can achieve more.

We all start our days pretty much the same: We get up, start the workday off with the best intentions to have the most productive day possible — hopeful that we may complete all that needs to get done. Yet somehow, no matter the day and how we feel, we all have the same automatic response to people’s question of “How are you?”

Let me guess your response. Is it: “Good, busy” or some iteration of that response? I thought so. I know I say this almost every day, even on days when things weren’t that busy. Is it just because we have nothing else to say, or maybe because it feels noble or accepted to be busy? After I became aware of my automatic response, I began to notice that I was making my life busy, even when it didn’t have to be. Small things would pop up, that would suck my time. I noticed I was always busy, rushing from one thing to the other, not always being the most productive with my time, I realized that I was probably manifesting all these events and circumstances in my life that were causing me to have less time for myself. Wanting to stop this behavior and manifesting (as I saw it), I became intentional about how I portrayed my day/life, whether it be during a conversation with a friend or in response to the question “How are you?”

I decided that if I could shift my focus from being “busy” to just “being”, maybe I would experience less stress and achieve more. I am still a work in progress, and although some days are better than others, incorporating the four steps below has helped me create more time to just “be”, and do things I enjoy.

Having taken on this transformation myself, I’m offering some simple practices and tips to bring into your life below.

Change Your Auto Response

The first and most important step is to become aware of how you typically respond when someone asks you “How are you/how’s your day going?” Sometimes we may feel guilty for having a “good” or “wonderful” day, especially if we know others are not sharing our experience. Instead, in order to “fit in” with the misery, we tend to find something negative to say, such as a complaint about how busy we are and there’s too much to do, with too little time.

The more we focus on just how busy we are, and put that out there, the more busy-ness comes back to us. It’s the law of attraction, working its magic like it always does. Make an effort to shift your way of thinking and change your response.

Learn to Say No to Commitments

I will be the first to admit that learning to say no to commitments is very hard to do, especially if you’re a people-pleaser or suffer from FOMO (Fear of Missing Out). I overbook and over commit all the time. If this sounds like you, become aware of your need to always say “yes” when you don’t really want or have to. Becoming comfortable with the fact that you do not need to attend every group dinner or 3 birthday parties in the same evening will ease your anxiety like no other. Your friends will not forget about you (and if they do, then maybe you shouldn’t be friends with them). Learn to say no.

Write Down Affirmations

I find it helpful to write down affirmations for things I want in my life. This helps me find clarity and focus on what it is I want to change. If you repeat an affirmation often enough, your mind starts to think it is real, and soon your affirmation becomes a belief. Once it becomes a belief, your circumstances start to change to hold true to your affirmation. Affirmations are great for all areas of your life, but here are a few examples of affirmations to help create more time: “I have more than enough time” and “Time is abundant and I can do all the thing I want in my day” and “I am never rushed, and go through my day with ease and grace.”

These are just a few examples, and by no means the only affirmations to use for this subject. Try writing your own affirmations, using words and phrases that resonate best with you.

Visualize Yourself with More Time

Take a few minutes at the end of your day (or anytime, really) and visualize all the things you would do with your extra time. Would you sleep in, go for a walk, call a friend and catch up, read a book, exercise, cook a nice meal, and/or catch up on your favorite TV show? The possibilities are endless. The key to visualizing is, however, to do it regularly and when visualizing to feel the relaxed and happy feelings associated with having the “extra” time to do things that you enjoy, instead of rushing from one thing to the next.

At the end of the day, it’s up to make these small changes. No one else can do it for you. Wishing you all the time in the world!

What are your ways to practice a happier, healthier life? Share your tips with us in the comments below.

Behold: 20 Crazy Hot Sports Bras for Fitness Lovers

We all know the hardest part of working out is finding the motivation to actually get to the gym. Add the unbearable elements of the winter chill into the mix and your workout is pretty much shot. So how do you get out of this rut? By tricking your brain to work out wearing the clothes you love. Say what? Yup–we recently found research that shows that we’re much more motivated to work out (and push ourselves harder) when we like our work out clothes.

What’s more according to Medical Daily, “wearing flattering and fun clothes can increase our confidence, and in turn, our overall performance, helping us get the most out of our workout. Simply put, a trendy athletic wardrobe can work as a motivator to get us to the gym, even when we’re not feeling our best.” To help you feel motivated to hit the gym, we rounded up 20 cute sports bras that will keep you both motivated and stylish.

Note: According to Amazon shoppers, this is the “best” sports bra for busty women.

As we head into fall — aka the season that’s best known for ruining our skin and hair — we’re rounding off on the best probiotic beauty supplements.

3 Reasons Why You Need a Roth IRA — Even If You Have a 401(k)

If you’re saving for retirement in a 401(k) or other workplace plans, kudos to you. You’ve taken a major step towards saving for retirement.

But, don’t stop there.

One misstep many people make when planning for retirement is only contributing to their company-sponsored 401(k), not knowing that they actually have other options. Because of their unique benefits offered, you should also consider investing in a Roth IRA, too. What is it? How do you get one? What does it do? Thankfully, we’re here to give you an easy-to-understand outline of what this particular account is.

Here are the most valuable lessons I learned from chatting with a financial advisor at Ellevest. As it turns out, retirement wasn’t so confusing after all.

What is the Simplest Way to Define a Roth IRA?

A Roth IRA is a type of ‘qualified account’, it’s not an investment. This means it has certain tax advantages associated with it. You can start by opening an account at a financial institution of your choice, and then fund it. Individual Retirement Accounts like a Roth were created in Congress to allow individuals to save for retirement.

If you are eligible to contribute for a Roth and are under the age of 50, as of 2018, you can contribute up to $5,500 a year to it. If you are older than 50, you can contribute up to $6,500 a year. See what your Roth eligibility rules are and if you qualify.

How is a Roth IRA Different from a Traditional IRA or a 401(k)?

For most accounts that fall under “qualified” accounts — like a traditional IRA or a 401(k) — you pay taxes on the money you withdraw in retirement. This is not the case for a Roth IRA. According to Ellevest, a digital investment platform for women, contributions to a Roth IRA are made with after-tax funds, and the assets grow tax-free. Unlike a Traditional IRA, withdrawals from a Roth IRA are usually tax-free.

The big takeaway here: You fund the account with after-tax dollars, and the money you contribute will grow tax-free, assuming you do not withdraw until you are at least 59.5 years old. In other words, when you withdraw the money in retirement, you pay no taxes on it.

How Can I Get a Roth IRA?

You can start by opening an account at a financial institution of your choice, and then fund it. Ellevest can open an account for you and it takes less than 10 minutes to do it. All you have to do is head to the Ellevest website, answer a few questions about yourself and your income, and you can see if you qualify. It’s a pretty easy (dare I say— enjoyable — process)

Got 10 minutes? See what your Roth eligibility rules are and if you qualify.

How Does Ellevest Make its Initial IRA recommendation?

Their recommendation of whether you should open a traditional IRA or a Roth IRA for your Retirement goal is based on their estimate of your eligibility to contribute to a Roth IRA. This estimate is based upon the salary you make (or the household income, if you’re married).

If the salary (or household income, if filing jointly) that you entered is greater than the current year’s IRS allowed income limits for contributing to a Roth IRA, they will recommend that you open a traditional IRA. However, if the salary (or household income, if filing jointly) that you entered is less than the current year’s IRS allowed income limits for contributing to a Roth IRA, they will estimate your retirement forecast with a Roth IRA and your retirement forecast with a traditional IRA, and then recommend the account type with the higher forecast.

See what your Roth eligibility rules are and if you qualify.

So, Why Should I Complicate My Life with Another Retirement Account?

Here are Three Good Reasons:

Given the uncertainty of your tax situation decades into the future, it makes sense to hedge your wins with a traditional 401(k) and a Roth.

See what your Roth eligibility rules are and if you qualify.

2. Flexibility as you save: “The first and foremost reason [to invest in a Roth] is the flexibility of distributions,” Michael Bucci, senior manager of investment strategy for retirement plan services at Schneider Downs Wealth Management Advisors in Pittsburgh tells USA Today.

Another huge benefit of a Roth is you can take out your Roth at any time, without taxes or penalties. If you pull out investment earnings early. Still, you should know that you’ll owe taxes and penalties on that money.

A further benefit is a Roth can act as a backup emergency fund (more on what an emergency fund is and how to build one here). So, in the long-term job loss or a big move, for example, having a Roth can be a blessing.

See what your Roth eligibility rules are and if you qualify.

3. Tax diversification: When you get to retirement age, you’ll be so happy you have a Roth. Why? Mostly because when you’re retired, if your traditional 401(k) or traditional IRA withdrawals are about to bump you into a higher tax bracket, and you still need more money, you can withdraw that from your Roth.

Given the taxes that you’ll owe on traditional 401(k) and IRA payouts, tax-free money from your Roth can act as a happy buffer that lets you avoid that higher tax bracket. “You can choose which account to pull from year to year, depending on where you fall in the income level or where tax tables are as a whole,” Bucci tells USA today.

Your tax-free Roth withdrawals also can help reduce taxes on your Social Security benefits. Depending on your income, either 50% or 85% of your Social Security benefits may be subject to tax. The calculation of this tax is based on a specific income threshold. If your income is over that amount by just one dollar, you may get bumped into paying taxes on more of your benefits.

In this case, however, withdrawing income from a Roth rather than a traditional IRA or 401(k) may prevent you from hitting that higher threshold where 85% of your benefits are taxed.

See what your Roth eligibility rules are and if you qualify.

Next up: are you self-employed? Here are retirement options for you.

Disclosures: We’re excited to be partnering with Ellevest to start this conversation about women and money. We may receive compensation if you become an Ellevest client.

9 New and Must-Know Etiquette Rules for Hair Salons

In 1872, Florence Hartley wrote The Ladies’ Book of Etiquette, and Manual of Politeness: A Complete Hand Book for the Use of the Lady in Polite Society, intended to declare the proper etiquette for use of the lady in polite society. One-hundred forty-five years later, many of the same etiquette situations in women’s beauty salons are still present. To add-on, many new queries now come to play.

The question of if we can use our phones during our salon visit is one big query on its own. Is texting ok? What about if you hate your hair? Should you chat with your stylist the whole time? And, in this age of expensive stylist, how much exactly do you tip? We get down and dirty with the answers to a few of the nuances of modern salon etiquette.

After all, you definitely don’t want to upset your stylist (ahem, your hair is in their hands).

Keep reading for everything you need know about hair salon etiquette. Plus, shop a few of our favorite products from Oribe, the most luxurious hair product line.

If You’re Early, You’re On Time

You’re not the only one having a bad hair day, so help all the girls out after you, and arrive on time. Like any appointment, always make sure to give yourself a five minute leeway before your scheduled time. If you’re running a tad behind, give the salon a jingle so that they can make accommodations. When the stylist isn’t trying to beat the clock, she won’t stress about rushing your perm or upsetting her next client.

No Cell Zone

If we’ve managed self-control at the dinner table, behind the wheel, and in a business conference, we can while sitting in the salon chair. If your head is tilted toward the screen or your hand is to your ear, don’t expect to have an even trim or ombré highlight when you look in the mirror. Plus, it’s polite to focus on the person doing your hair, rather than the one on your screen.

Communication Is A Must

Keep your stylist in the know of your “hair-abouts”. At every visit update them about any new hair products, treatments, hot irons, accessories, or dilemmas. This will give them an idea for what treatment is best to keep your locks healthy and flowing.

Picture This Hair

There’s a reason why they have a stack of photobooks full of hundreds of hairstyles in the salon. Showing an image of your ideal hair is much easier than talking in hair-lingo. Bring an image of your favorite hairdo or red carpet look — and it will majorly help out your stylist. Need some inspiration? Head to our Pinterest “Great Hair” board for your guide to hair looks.

Trust The Scissors

You are most likely not the first head of hair your stylist has cut, colored, or styled. They have had plenty of experience and training perfecting their skills, so just sit back, relax, and take in the yummy aroma of hair product. It’s incredibly annoying when you have a client questioning your method, product choice, and every snip.

Salon Talk

While you don’t have to become besties, it’s always smart to try and build a relationship with your stylist, especially if you plan on returning in the future. But remember, the girl in hot rollers next to you, and the girl getting her hair washed down the hall, can hear your conversation. So filter out loud chatter, gossip, and anything super personal.

Tip Some Love

No matter how expensive the hair treatment, it’s always considerate to tip your stylist and any assistants. We put a lot of pressure on our stylists to make our hair look fab, and they deserve some extra love. A general range to tip is 15% to 20% of the fixed price. If you are especially wowed, add on a little extra.

Hate Your Hair

Can’t Make It

The worst thing you can do to the salon and your reputation is be a no-show. If an emergency happens or your hair can wait a few more days, simply leave a message with your salon that you can’t make your appointment. Cancelling within 24 hours is preferred, because it gives your stylist the chance to make someone else’s hair flip fabulous.

Need some inspiration? Head to our Pinterest “Great Hair” board for your guide to hair looks. Plus, shop all the best products you need for the perfect blowout.

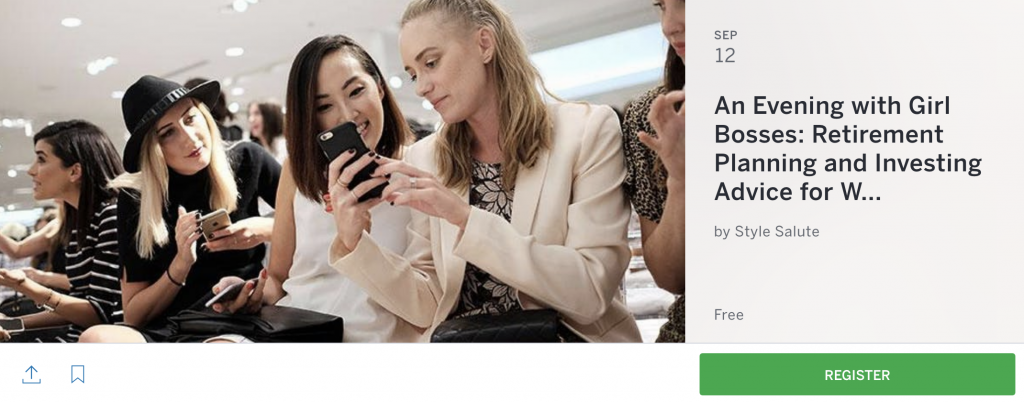

Calling all L.A. Girls: We’re Hosting an Empowerment Event — and You’re Invited

Calling all L.A. girls: We’re hosting a women’s empowerment event — and you’re invited.

Our goal for the event is to enable women to be the boss of their money and walk away feeling like a more confident version of themselves through panels, a fireside chat, a cocktail mixer and more. We want to show the power women can achieve in all areas of their life, from how to slay at work to how to be the boss of their money.

Beyond all that, like all Style Salute events, we promise that there will be great conversations, amazing guest speakers, special in-event giveaways and so much more!

Can’t make it to LA in Septemeber? No worries. While we’d love to see you IRL, we totally understand you’ve got a busy schedule. That’s why all content will be streamed to our audience across Style Salute social channels for a fully digital experience. So, make sure to like and follow us STAT.

Stay tuned over the coming weeks as we share more details of our next-level lineup of activities, performers, and speakers joining us. Want to be the first to know? Sign up for our Style Salute’s newsletter HERE.

This is a free event – open to anyone who wants to learn more about retirement planning and investing in a fun, intimate environment.

Want to go? RSVP here!

Date & Time

Wed, September 12, 2018

6:00 PM – 9:30 PM PDT

Kendall and Kylie Jenner Both Love This $33 Brami (Buy it Here)

The only thing better than a new top is an affordable new top, and Kendal and Kylie Jenner both seem to agree. Both Jenner sisters were spotted wearing two different versions of the Meshki Yvonne Crop Top ($33), and it’s immediately become our go-to top of the season.

Part bra, part cami—a brami is like a crop-top, only better. Yet another 90s revival piece that’s made its way back, the brami is now everywhere. You’ve probably spotted the trend on Instagram recently on the likes of Gigi Hadid, Emily Ratajkowsk, and a slew of other influencers. And despite being more on trend than ever, this top is only $33.

Scroll through to see how the Jenner sisters’ are wearing their matching Meshki tops, and shop the trend for yourself.