Penelope Cruz once said, “On days that I’m not working, I like to keep it natural, buuuut I always wear mascara. It’s the little black dress for your eyes. “

And I have to agree.

Because even when I’m just going to work or grocery shopping, wearing mascara makes me feel well… pretty great. Still, it makes me shudder thinking about what exactly is in the dark, inky formulas that make up most of the mascaras we see on beauty shelves. Flip over to the ingredients section of your mascara, and you’ll notice a long list of harsh ingredients such as parabens, phthalates, petrolatum, and sodium laureth/sodium laurel sulphate.

If your eyes are easily irritated, or if you’re just wanting to start a more natural beauty routine, consider natural mascara. A natural mascara can help you look great without inflicting any harm to your eyes or skin.

With your eyes in mind, we searched the internet for the best natural mascaras you can swipe on without worrying about irritation or harming the environment. Below, find our favorites, a collection of toppers and crystal-infused formulas to make any day feel special.

Keep scrolling for all the goods.

Craving more beauty secrets? Check these stories out:

These Are the Best 24 K Gold Masks for Every Budget

The Affordable Mask Karlie Kloss Swears to Combat Puffy Eyes

Valentine’s Day Outfit Ideas That Aren’t Over the Top

What Are Adaptogens? A Guide To Healing Herbs for Stress and Fatigue

In the world of health and wellness, the word “adaptogens” is making quite the buzz. These so called “magic herbs” are the latest health and wellness craze, showing up everywhere from your morning smoothie to supplement aisles. Welness advocates say these “super herbs” can adapt to provide whatever your body needs at a particular moment—whether that’s a boost of energy in the morning, an evening wind-down, or an overall sense of balance.

So now you might be wondering: What in the world these miracle herbs are, and more important if they actually work to do what they promise.

We reveal all you need to know, including what these herbs are, the research behind their effects, and the best supplements out there – all vetted by our editors.

What Are Superherbs?

Made from herbs and roots, adaptogens are nothing new. They’ve been used for hundreds of years, and have been back front and center as of lately.It may sounds new but adaptogens was actually coined in 1947 and refers to substances that theoretically “adapt” to what your body needs and help protect against various stressors. Although the science is not certain, the wellness set cannot stop touting the purported benefits. Benefits include supporting the body’s adrenal glands, reducing stress levels and regulating hormone responses for an overall sense of homeostasis, or balance.

What Exactly Are Adaptogens (And How Do They Work)?

Made from herbs and roots, adaptogens are nothing new. They’ve been used for hundreds of years for stress relief and energy. These magic herbs are part of a special group of herbs known to help your body adapt to its environment. In a stressful situation, adaptogenic herbs maintain and restore balance, normalizing your physiological response to prevent your body and mind from jumping into overdrive and becoming exhausted at every stressor.

According to registered dietician Sarah Greenfield, “Adaptogens are plants that help our bodies respond more effectively to stress. This can be through calming us down or giving us a little boost of energy. Our bodies have a system in place that allows us to experience and interact with stress. It’s called the HPA axis which stands for the hypothalamus, pituitary and adrenal axis. The HP are areas of the brain that sense stress and send signals to the adrenal gland that secretes cortisol to help our bodies handle stress. Adaptogens work on this pathway and help our bodies feel less of a negative impact from stress.”

How Do Adaptogens Work?

When you deal with chronic stress, this is the cycle going on in your body: You encounter a high stress situation. Your body releases hormones in response to the stress. These hormones are meant to deal with the potential threat. The hormones then are activated through your adrenal glands, causing you to … well, stress.

Enter, adaptogens. This class of herbs supports your adrenal glands, allowing them to respond to this process more efficiently. In some cases, adaptogens help shut them down more quickly – ie. stop your body reacting to stress or they allow you to stay more in control and let the situation pass.

What does this mean for you? Stress is a known precursor to an extensive list of diseases including but not limited to heart disease, asthma, obesity, diabetes, depression, digestive disorders, and accelerated aging. It is also a key factor in damaging skin cells that lead to aging skin, breakouts, dull + tired skin, or dry + irritated skin. This is why adaptogenic herbs can be an essential aid to protect your skin, health, and wellbeing.

Check out the supplement Uber Energy, packed with these clinically researched adaptogenic herbs to assist your adrenals and naturally boost your energy (i.e. no more 3:00 PM slump).

How Can I Use Adaptogens?

Many adaptogens have been clinically researched. Some can be consumed through eating, but most are accessible through powders and pill forms. Some industry favorites include Hum Nutrition’s Uber Energy for fighting fatigue (no more mid-day slump) and Big Chill for stress relief.

The key here is knowing what you hope to benefit from these supplements. For example, if you are looking to combat all over fatigue, inflammation, and depression, Rhodiola Rosea is a good choice. Rhodiola Rosea is one of the most clinically researched adaptogens with widespread traditional uses. With the ability to aid in regulating the production of cortisol, it manifests anti-fatigue, anti-inflammatory and anti-depression benefits. You can find Rhodiola Rosea in HUM’s Big Chill supplement for natural stress relief.

Here are a few of our favorite adaptogenic supplements to support your mind and body.

For Stress Relief

The rhodiola rosea root extract found in products like Big Chill can work to keep you focused and calm. This supplement is clinically proven to raise your focus to cope with stressful situations.

Greenfield Says: “Rhodiola, the main adaptogen in Big Chill, has been shown to help decrease stress. One study looked at students taking an exam and found the ones who took rhodiola performed better due to a decrease in pre-test jitters and nerves.”

For Fighting Fatigue

Here’s a breakdown of how it works: L-Tyrosine, an amino acid that is used to make protein can enhance both physical and mental performance, especially when under stress. So where can you get this boost? Supplements like Uber Energy, which include B5, B6, L-tyrosine, as well as a variety of adaptogenic herbs including eleuthero, ashwagandha, and rhodiola rosea, support consistent energy through adrenal strength. This combination of herbs and vitamins is designed to fight fatigue and tension.

Greenfield Says: “Ashwagandha is one of my favorites because it helps decrease stress and can impact fatigue. It’s a great way to get clean energy without caffeine! It will take a couple weeks to kick in because its a supplement, not a medication or stimulant.”

Sarah Greenfield is an RD, CSSD, HUM’s Director of Nutrition and Education, and also a TedX speaker and the founder of Fearless Fig.

Looking for more healthy tips? Check out 12 Healthy Habits Successful Women Swear By.

Plus, here are more beauty and wellness topics for you…

10 Ways to Reduce Bloating Fast

The Best Probiotics for a Healthy Gut and Brighter, Better Skin

What Are Adaptogens? A Guide To Healing Herbs for Stress and Fatigue

Questions? We’re here to help. Leave us a comment and we’ll get back to you!

These Under $200 Boots Will Sell Out (Mark Our Words)

Trend-wise cowboy boots, and croc-effect textures are leading this winter, and there are five styles in particular which are becoming Instagram bait.

20 Percent Counts — Here’s Why The Gender Gap Is Important

You know here at Style Salute, we’re all about the equality and the positive power of women. That said, we recognize that any way you look at it, money is power. Want to start your own business? Get an advanced degree? Go on an adventure around the world? None of this is possible if we aren’t in control of our finances.

But, like it or not, historically, financial matters have been labeled a “man’s job”. As the so-called “head of the household”, men considered themselves experts when it comes to money, while women were seen as being “bad at math” and “damsel in distress — therefore, not able to understand it. Unfortunately, this also falls back on the false stereotypes of women as the “irrational “and “emotional” gender. But, we’ve had enough. For too long — and even today — the narrative around women and money — has been wrong. So, you see, money is a feminist issue, and the way it affects women financially is multi-pronged.

For starters, it keeps us in bad relationships, has us working more, and it negatively impacts career advancement—even though it shouldn’t. “It’s a story that repeats itself, again and again, even today we tend to give that power up in a relationship when we can only imagine a happy future. Being in financial control is about playing offense. And it’s about playing defense. Money is power, and knowledge about money is power,” says Sallie Krawcheck, a woman who successfully penetrated the ranks of Wall Street, becoming one of its most powerful players, is offering a shoutout for women in the form of a new digital investment platform for women.

This fight isn’t over yet.

We need to understand what we’re dealing with and learn how to budget, save, and invest in our futures. Her company Ellevest helps women like us prioritize our financial goals and make more money.

Let’s lay out the facts of this looming gender gap that’s holding us back from reaching our full financial potential.

It pains me to say, but women are paid 20 percent less than their male counterparts (you read that right) for performing the same job, according to the Institute For Women’s Policy Research. That is, for every dollar earned by a man working full-time, year-round, a woman working full-time, year-round earns $0.76.

Sadly, women of color fare even worse. Much of it has been “math is scary and it makes me feel emotional and my friend lost her job, so what if I lose mine too? But if I give up my one latte a week, I can be a millionaire” syndrome. In addition, a key means to building our wealth — investing — hasn’t felt accessible to us, because let’s be honest all those bankers are playing a “man’s game.” The high account minimums (easier for the guys to reach, given the gender pay gap), the treatment of investing as some type of competitive sport, the over-complicated communication of investing issues — if these didn’t say “investing isn’t for you”, then the ultra-masculine bull brand symbol of Wall Street certainly has.

Yet, the future appears slightly brighter for the upcoming generation of females. More and more millennial women are attending college and earning a degree that will promote them as successful businesswomen, entrepreneurs, and leaders. The prediction is that females will have their chance to rule the world when young women’s wages overtake men’s by 2020. What else helps is the fact that while our debt may be greater, we have a better credit score than males, which is a huge advantage when applying for future loans or a prepaid debit card. Additionally, women today show more monetary responsibility, proving that we are capable of wisely budgeting, saving, and investing.

It’s not okay that our male counterpart will spend less of his life at his desk, and make more money. Earning 20% less in return for our hard work makes it appear like, well, we are second string. And being second means less wealth and resources for a well-deserved secure future. “I promise you: It’s not us, it’s them. We’ve been held back from engaging financially — and it costs us, big-time,” says Krawcheck.

So, how can we create balance?

Sallie Krawcheck keeps us encouraged with her advice that, “There are plenty of unseen barriers, but as far as what you can control, it comes down to money. I call investing “the best career advice women aren’t getting”— because giving yourself the opportunity to earn higher returns through investing means we can have greater career freedom.” Choosing to invest with Ellevest is just one more way to decrease the 20% gender gap, and ease your monetary anxiety.

And feel free to start small — Ellevest has no minimum balance, and your personalized financial plan is their gift to you whether you invest with them or not.

So, how about it ladies? Would you rather be polite and damsel-like or equal? We think we know the answer. If you do anything today to help your future, let it be this: sign up for a free personalized financial plan today.

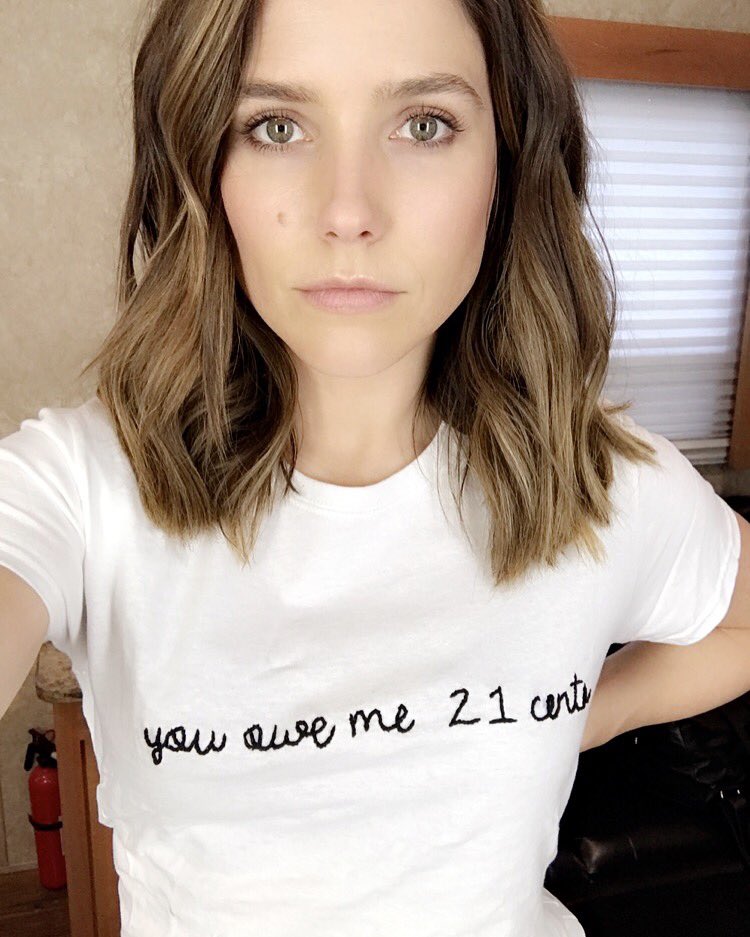

Want to wear equality on your sleeve? Shop one of our favorite tops that Sophia Bush famously wore, “You owe me 21 cents” here.

Ready to close the gender gap for good? Sign up to get your free personalized financial plan from Ellevest today.

How To Start A Business In 2019 – 5 Key Lessons For Entrepreneurs

With the promise of a New Year often comes the desire to go after your dreams. For many people in the U.S., that dream is to finally start their own business. In fact, every month, more than 500,000 people in the U.S. start a business, a trend that’s been rising for three years in a row.

Luckily, if you’re thinking of joining the entrepreneurial caravan, it’s easier than ever to finally make that jump. The start-up costs associated with being an entrepreneur have been dramatically driven down by technology, and this new business culture supports a wide range of work options.

Growing your business will be a lifelong expedition that nurtures ambition, discipline, and confidence. It’s a highly rewarding experience, and with the right mindset and tools, you’ll be able to reap the rewards in due time.

For those of you who have not already started a business, or are trying to figure out how best to start your business, this post will help you learn the 5 key steps to turn your business vision into a successful reality.

1.Manage your business all in one place

As an entrepreneur, handling all aspects of the company can be tricky. It might be worth getting that extra bit of help by bringing a CRM (Customer Relationship Management) system into play. If you’re not already familiar, a CRM system basically takes the guess-work out of expanding business and retaining clientele.

HoneyBook is a CRM software designed exclusively for entrepreneurs and freelancers to book more clients, manage projects and get paid – all in one convenient place. Their goal is to make sure that each partner has the best possible experience and they give each collaboration the attention and resources needed to make it a success. You can start a free trial today. Plus, Style Salute readers get 50% off their first year. Get into it here.

2. Organize your paperwork

Being an entrepreneur, small business owner, or freelancer is not easy… especially when it comes to all the business and managing you have to do. There are a lot of formalities involved when starting a business. From selecting a form of ownership to getting a tax identification number. Be sure to check out the US Small Business Administration for more information on these crucial details.

One way to make it easier on yourself is to automate with Honeybook, your all-in-one project, invoicing and payments management tool. HoneyBook’s robust features can help you manage everything and, yes, keep on track with it all.

Plus, Style Salute readers get 50% off their first year. Get it here.

3. Create a financial proposal

When writing your business plan, make sure to pay attention to the fiscal side of things. You’ll want to create a solid, easy-to-follow financial proposal that outlines how much money you’ll need to launch your business, how much you intend to make in the first year and how much you’ll spend in the first year. When you do this, you’ll find that you have to summarise and aggregate more than you might with accounting.

A financial proposal is useful when seeking investments and to better understand how your business will fare in terms of profits and losses. It’s a document that you can always refer back to update.

4. Look professional and improve your client experience

Ultimately, your client experience can look however you like. However, it’s vital that the experience is efficient and easy to understand for the client. The way in which you communicate with your consumers and respond to their needs are key elements that need to be considered carefully before creating a client experience strategy. Doing so will also ensure that you attract the right kind of following for your business.

HoneyBook is extremely user-friendly in this respect with an all-in-one project, invoicing and payments management tool. Plus, you can book clients, manage projects and get paid – all from one place. Curious? Sign up for a free trial of HoneBook business management software designed just for creative small businesses.

5. Make sure your retirement plan reflects your status

Being self-employed has its perks, but it also means that you are responsible for protecting yourself financially. Unlike employees with access to 401(k) plans, it’s up to you if you want to set money aside for retirement and your golden years.

The good news is that if you’re working as your own boss, there are plenty of retirement paths to explore. The most common retirement accounts for those that are self-employed are SEP IRAs, Simple IRAs, and Individual 401(k)s. Similar to retirement accounts offered by employers, these retirement plans have two factors in common. They have up-front tax breaks and tax-deferred saving, meaning you don’t pay taxes until you withdraw the money years later in retirement (the Roth version of the individual 401(k) is slightly different.)

How do you know which plan is best for you? You consult with an expert. Here’s more on which plan is best for you.

Up next: In your 20s? For most of us, our 20s are a decade of #adulting, including with our money. So where do you start? Here’s a roundup of 4 steps to take now, from our friends.

The 3 Supplements Women in Their 20s and 30s Absolutely Need

In your 20s and 30s, your body is young and can tolerate the abuse you put it through—from late nights to greasy food. But that won’t last forever. The health habits you develop in your 20s and 30s will have an impact throughout your life. And while you can’t turn back the clock, you can get healthier by making better choices now. “After all, you only get one body, treat it well,” right?

Help yourself out by taking care of your body with regular exercise, eating well, and taking the right supplements for your age.

But because just taking a general multivitamin isn’t always enough, we called on registered dietitian and founder of Fearless Fig, Sarah Greenfield, who talked us through which vitamins and supplements you actually need in your 20s and 30s.

If you really want to stay healthy, “do it from your gut,” advises Greenfield. She understands the life of a woman in her 20s and 30. Because stress, the diversity of our diets, exposure to toxins, and so many other factors can impact our bodies ability to stay regulated and balance, supplements should be added to our diet to add an extra boost to work more efficiently. “They also work to help us maintain adequate amounts of the essential vitamins, minerals, and other gut healthy nutrients we may lack in our diet.”

Keep reading to find out which vitamins you should prioritize at this stage of your life. Your body will thank you.

“Probiotics like Gut Instinct can help your body balance your microbiome, which plays a big role in your immune system. Our bodies naturally make enzymes to improve digestion and to breakdown foods.

But, as we age and if we are under large amounts of stress, our enzyme levels can decrease leading to digestive imbalances. Research shows that broad-spectrum enzymes like those that are in Gut Instinct can help breakdown lactose, proteins, carbohydrates, fibers and fats to help improve digestion.”

2. Fish Oil

“Many studies have discovered that the omega-3 fatty acids, EPA and DHA, found in the fatty layers of cold-water fish can keep your heart and body healthy. Research connects the fatty acids in fish oil to healthy hair and skin function (hence all the talk about fish oil being good for your hair and skin). Supplements like Hum Nutrition’s OMG which are ultra pure fish oil support even skin tone, a healthy heart, brain & body.

*No fishy aftertaste.

3. Digestive Enzymes

“Digestive enzymes are a great way to combat bloating and support healthy digestion. This is because our bodies naturally make enzymes to improve digestion and to breakdown foods. However, as we age, the enzyme levels in our bodies can decrease leading to digestive imbalances.

Research shows that taking supplements like Flatter Me that offer a broad spectrum of enzymes can help breakdown lactose, proteins, carbohydrates, fibers and fats to help improve digestion.”

Want more wellness recommendations? Next, check out how 10 minutes of meditation a day can boost your focus.

Want personalized recommendations from a Registered Dietician based on your unique concerns and needs? Take this quick online quiz!Sarah Greenfield is an RD, CSSD, HUM’s Director of Nutrition and Education, and also a TedX speaker and the founder of Fearless Fig.

Up next, take care of your skin with 10 Habits Women That Have Great Skin Swear By.

20 Ways to Wear Your Dresses With Boots

For winter, wearing your dresses with tights and boots is the best seasonal ensemble.

5 Smart Things To Do With Your Money in Your 20s

Welcome to the decade of adulting. For a lot of us, our 20s are a pivotal moment in time when reality hits hard. We’re no longer kids free from care. Instead, we’re officially adults trying to govern a Rolodex of responsibilities, while standing at a muddied crossroad between where we are and where we want to be. Rest assured, our 20s are supposed to be confusing. It’s perfectly fine to screw up – so long as we learn from our mistakes.

For myself, the transition from school to adulthood has been an exhaustive eye-opener, and I’ve already begotten my fair share of slip-ups. I’ve experimented with questionable fashion trends, I’ve been on even more questionable dates, and I’ve trusted the wrong kind of people. While most of the offshoots are salvageable, there are some that aren’t, particularly when it comes to personal finance.

Let’s rewind to my early 20s. I majorly lucked out with a no-student debt status, jobs that funded my lifestyle, and the financial backing of my parents in case of emergencies. I was indeed comfortable, but I wasn’t vigilant about my expenditure, and I knew I’d come to regret it one day despite any external warning. As I later welcomed my mid-20s, I underwent quite the personal renaissance, and it finally sunk in that I needed to craft a more prolific approach to both spending and saving.

I suppose the reason I was so idle about my finances in the past was because I never bothered to educate myself properly. I’d write it off as something too complicated or iffy to conquer. Besides, that’s what financial advisors and accountants are for, right?

Wrong. Honestly, I look back at my younger self and cringe. These days, I now believe that there’s nothing more empowering than feeling entirely self-sufficient. But like the old me, there are still too many gals out there that shy away from market reports and economic terminology because they consider it to be “a man’s world”. The reality is women can’t afford to be oblivious. We live 6-8 years longer than men, retiring with two-thirds as much money. We have to look out for ourselves and be financially savvy right now so as not to fall even further behind.

To help get you going, I’m sharing five smart things to do with your money in your 20s.

1. Create your own budget

I used to hate budgeting because it would shed light on facts I didn’t need to know – like how I overspent on scented candles. When I got my first job, I was too excited by the prospect of earning my own money, which made me privy to unnecessary spending. I knew I needed to put a cap on it, and budgeting was the only method that encouraged more self-control in this realm.

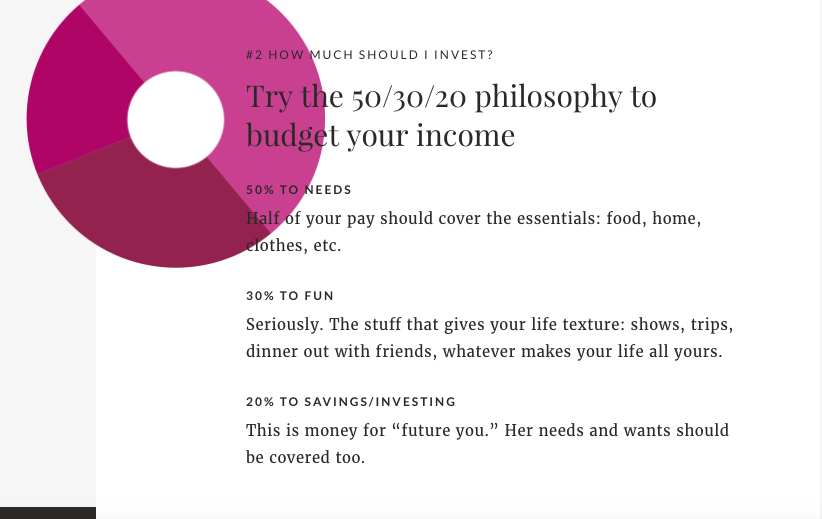

If you’re stuck on how to go about it, I recommend the 50/30/20 rule since it’s a pretty simple, systematic way to monitor your outgoings more closely. According to the rule, 50% of your take-home pay goes to needs (think bills, food, transportation, etc.), 30% goes to wants (like new clothes or travel), and 20% goes to your future (debt payments above minimums, saving and investing). It’s okay to adjust the numbers here and there, but try to stick to it as much as you can.

2. Get that employer match

One of the greatest perks of having a job is the 401(k) employer contribution match if it’s available to you. In America, the most common type of 401(k) match is 50 cents on the dollar up to 6%. So if you put 6% of your paycheck into your 401(k), your employer will then put in 3%. As such, your employer is essentially handing you a 50% return on your money. Winning.

3. Pay off high-interest debt

If you’re looking to minimize or avoid debt, it’s worth taking advantage of your employer’s 401(k) match to pay off balances that have an interest rate of 5% or more. Anything with an interest rate under 5%, like a federal student loan, is generally okay if you continue paying the minimum until it’s fully paid off.

Ellevest suggests adopting the “debt avalanche” payoff tactic, which is intended to save you the most on interest. First, list all your balances in order from the highest interest rate to the lowest. Then, if you can, pay extra on the balance with the highest interest rate while paying the minimum on the others. Once that’s paid for, you can continue checking off the rest of the list in a similar fashion.

4. Save for emergencies

When I was living in the States, I would often wonder if I had enough money set aside for a last-minute airfare in case anyone back home in England was unwell. Even though it was an unpleasant thought, I needed to be pragmatic. Thankfully, I never had to buy that ticket, but it does highlight the importance of having an emergency fund readily available, whatever that emergency may be.

If you have a reasonably stable income, a useful way to prepare an emergency fund would be to save somewhere between three and six months’ worth of take-home pay. It’s also best to keep your fund in a high-yield savings account that’s FDIC insured and that you can access when you need to. More on what an emergency fund is and how to calculate your number here.

Don’t have an emergency fund set up– yet? Ellevest can help you set one up for free and help you reach all of your money goals. Sans judgment, finance jargon, and trust issues. Get into it here.*

5. Get started investing

Investing is merely another way to generate income. It might seem scary at first, but we have little reason to avoid it. Nowadays, companies provide us with more accessible, easy-to-follow resources to get started, and many of them don’t require a minimum amount to do so. Among said companies is Ellevest, which is a prime site to turn to, especially if you’re a total newbie to the world of finance. Before investing, identify your goals. For example, while it might not seem all that relevant in my 20s, a comfortable retirement is a vital long-term goal that I’ve made for myself, and so I can capitalize on investments accordingly.

Don’t have an emergency fund set up – yet? Ellevest can help you set one up for free and help you reach all of your money goals. Sans judgment, finance jargon, and trust issues. Get into it here.*

Ready to invest…

Here’s one way to do it with Ellevest. You can get a personalized portfolio in under 10 min. And it’s made by women, for women, with portfolios that allow you to invest in companies that support women. *

Pay yourself first: Your new resolution for 2019. Make sure a cut of every paycheck goes straight to your retirement or savings account and does not pass go.

Here are more personal finance topics for you…

What Is An Emergency Fund and How Much Should Be In It?

Make 2019 The Year You Get Started Investing

3 Reasons Why You Need a Roth IRA- Even If You Have a 401(k)

Disclosures: We’re excited to be teaming up with Ellevest to start this conversation about women and money. We may receive compensation if you become an Ellevest client.

5 Financial Habits That Can Help You Build Wealth

We are all guilty of overspending from time to time (or all the time). However, if you’re consistently spending over what you afford, you can fall down a scary downward spiral—and before you know it, you’ll be drowning in bad debt.

Don’t get discouraged, and don’t think it’s impossible to get back on a budget. Changing your shopping habits is absolutely within reach if you follow a few basic steps and get started now.

Every day, you’re presented with choices, and you have to make decisions. From waking up to your first alarm or snoozing, making that early yoga class or sleeping in, coffee at home or Starbucks. These choices not only affect today, they also have a huge affect on your future.

To reach your financial goals, you need to make appropriate daily choices today. You can’t have everything you want, and if you have big goals in life, you have to make sacrifices. Just ask Sallie Krawcheck, former Wall Street analyst and CFO of Citigroup turned founder and CEO of Ellevest, a digital investment platform for women. Whether you’re a recent college grad spending your first real paycheck or a seasoned professional, Krawcheck says tradeoffs are always needed when you have big goals in life.

Being in debt after a series of bad spending is scary, to say the least, especially as a woman. But, learning how to make better decisions is absolutely doable, and better yet, it can make you a lot of money in the long run. So, take a deep breath, look around yourself, muster up an attitude of gratitude, and learn to love your starting point. Budgeting doesn’t have to be painful (it can be fun—your decision).

By getting a handle on your shopping habits and knowing the things you spend too much money on, you’ll already be saving big. The most important thing is establishing a healthy routine and mastering the art of consistency.

We sat down with Krawcheck at Ellevest’s New York headquarters, and she was more than happy to explain not only how we can make better shopping decisions but als0 how her company benefits women—prepare to take notes.

Keep reading to learn more about how you can change your shopping habits and save big in 2018. Let’s get started, shall we?

1. MAKE A DETAILED BUDGET

First and foremost, find out how much you spend every month. Do this by looking at your bills and parsing the numbers. Putting pen to paper and budgeting out your spending each month will reinforce your goals and make them more manageable in the long run.

Once you know the number, set a realistic budget for everything you need based on your income. Consider how much money you’ll need for rent, food, shopping, and saving / investing (we’ll get to more of that later). The experts, (that includes us) say the best way to look at your salary is to look at your take-home pay and put is 50% for needs— rent, food, the essentials 30% for fun—dinner with friends, a really nice restaurant, shopping, and —10% for future you—retirement.

The most important part about this is being real with yourself. You know that you are going to be spending on those lattes every morning, you know you have a hair appointment, you know you’ll need more Fenty foundation by the end of the month. Note every detail. It is going to take a lot of time but will be worth it in the end. And make sure you’re putting away a certain amount of every paycheck for investing in future you. We invest in things like finally starting a business, going on a trip around the world, having a baby, buying a house.

Have goals you want to budget for? Whether your goal is to buy a home, have kids, or take that big trip, Ellevest will give you a free customized portfolio to help you nail it.

2. REMIND YOURSELF OF YOUR BUDGET DAILY

Once you have identified how much you can afford to spend every month, you need to be reminded of it. It is all too easy to forget the budget your create for yourself to solve this problem by either writing out your budget and posting it somewhere you see every day, setting a reminder on your phone, or downloading a finance-based app that sends daily notifications. Takeaway: when it comes to saving money, most people save what they don’t spend but when in reality they should spend what they don’t save.

Being reminded of your budget every day will help keep you focused on your goals.

3. AVOID IMPULSE PURCHASES BY SLEEPING ON IT

We all know the dangers of impulse purchases. One of the most straightforward and easy ways to avoid impulse shopping is by sleeping on it. Leave the store (or your online checkout)without buying the item that caught your eye last minute. If you are still fantasizing about the item the next day or next week, then go back and buy it. I know this is especially tricky when a sale is going on but it will help you save so much money. Money that you can keep to invest in your goals.

4. TELL YOUR FRIENDS

One of the biggest places millennials sink their money in to is social activities. It’s hard to turn down coffee dates with your friends, or bottomless Sunday brunches, or unnecessary nail appointments. These social activities often include spending that is not necessary and it all adds up. Making your friends aware that you are trying to save money this year will help you avoid looking rude by turning down expensive activities.

Plus, chances are they are hoping to save money too and will be more than happy to socialize via meal-prep and at-home nail parties. Try it and let us know how it goes in the comments below.

5. START INVESTING YOUR SAVINGS

One of the most important financial steps you can take in the New Year is to invest the money you make. CEO and co-founder of Ellevest, Sallie Krawcheck explains that “If you’re not investing, you’re doing most of the hard work around money (you know, going to work every day, turning in that amazing design, landing the difficult-to-close client, beating our sales projections)… but we’re only getting about half the reward. And so we’re depriving ourselves of the ability to take on more risks in our career if we don’t have a financial cushion built up.” . And platforms like Ellevest will automatically build a diversified portfolio for you based on your timeline and goals.

Make this the year you start investing, even just a little bit. If you’re just starting out, choose an investment service with a $0 minimum and low fees that is a fiduciary, meaning they are required to act in your best financial interest. Then start investing as soon as you’ve paid off any bad debt. The 50/30/20 rule is a great one — and if you’re not there yet, it’s one to aim for. This is the inequality we can start working on all by ourselves.

Following these five steps won’t ensure that you stick to your New Years Resolution, but it will certainly give you a head start. Read more about Style Salute’s smart money tips here and to learn more about how easy investing can be, check out these 5 things you need to know about investing.

Action for women

Make this the year you start investing, even just a little bit. If you’re just starting out, choose an investment service with a $0 minimum and low fees that is a fiduciary, meaning they are required to act in your best financial interest. Then start investing as soon as you’ve paid off any bad debt. The 50/30/20 rule is a great one — and if you’re not there yet, it’s one to aim for. This is the inequality we can start working on all by ourselves.

Disclosures: We’re excited to be working with the team at Ellevest to start this conversation about women and money. We may receive compensation if you become an Ellevest client.