On my first day of university, I walked into my empty dorm room, plopped down my bags and before putting my sheets on my bed or unpacking my clothes, I pulled out a print of Monet’s water lilies and tacked it above my bed. Whenever I got too stressed out and needed to calm down, looking at the print always took me to a serene place.

The power of art is not to be under appreciated and while visiting a gallery or museum is an exceptionally beautiful experience, turning your home into a personal showroom is even better. Having a great piece of art can transform a room from stale to stellar—however, choosing the right piece is a meaningful and personal struggle. While selecting art for your home is largely based on personal preference, as with most decor, there are some guidelines we recommend following to maximize your space’s potential. If you’re looking for ways you can decorate your home with art, we’re here to help.

Keep reading for our tips for choosing art for your home, plus shop 15 original affordable art prints we love under $200.

Rule 1

The dollar sign does not dictate value. You can get a great piece of art for a price without spending a months worth of salary. If you like the art and it speaks to you, it’s valuable.

Rule 2

The style of the room should match the art. Ergo, if your room is filled with antiques, consider a Victorian-style painting with an antique frame. If you have a modern flair to your home, it may be wise to invest in pop art with a sleek frame.

Rule 3

Size matters. If an art piece is too large, it will overwhelm and if the art that is too small, it will get lost and look out of proportion.

Rule 4

Color is key. When selecting art for a particular room, make sure the art pieces incorporates at least two or three colors that are dominant in the room.

Rule 5

Where art is placed is important. Art should typically be hung so that the center of the painting is at eye level

While rules are good to follow, they should be considered guidelines only— so get creative as you want. Before running of to your closest art dealer to shop some wall art, scroll down for my curated list of pieces. I know you’re busy so I went ahead and separated them in the four major categories of art: abstract, animals, figure and nature – so you can select which type of art is most fitting for you! Extra bonus: most of these are free shipping.

What’s your art style? Tell us in the comments below!

2,000 People Want These Leggings—and Now They’re Back

Calling all leggings lovers! Um, that’s all of us, right? This year it’s been all about transitional dressing–and for us girls, a flattering pair of leggings that can be worn anywhere is key. So it’s really no surprise that the best leggings are constantly selling out.

One, in particular, that we all seem to want is Lorna Jane’s Sammie Core 7/8 Tights Casual Pants. These leggings have sold out three times on the site making them one of the brand’s best-selling pieces. It’s no secret that we want what we can’t have but seriously these leggings are so good that if you try them on, there’s no way you won’t be wearing them home. Seriously. Lucky for us, Amazon just restocked the leggings—but if you want them, hurry because chances are they will be out of stock in no time.

Looking for more great pieces? One of the best places to shop for athleisure and leggings specifically is Amazon. From staple leggings (that don’t cost $120!) to the best sports bra , Amazon is a goldmine for unique and well-fit fashion items that won’t break the bank. Plus, those reviews can help filter the ones you want. But finding these pieces takes time, patience, and dedication in order to spot the chicest treasures among—simply put—the piles of stuff. Luckily, we’ve done the hard work for you and searched high and low to bring you the best leggings that we here at Style Salute HQ all unanimously agree are amazing. Whether you’re interested in getting the best leggings for working out or leggings for work, you’ll find something you love!

Scroll down to shop the mega-popular Lorna Jane leggings below, and if you’re on the hunt for more, go on to shop some more of our favorite leggings from Amazon.

Elevate a pair of plain black leggings with some mesh detailing, like these insanely popular Lorna Jane leggings.

We also love these fun Mono B leggings with mesh panel detailing that would add flair to any workout.

Yoga pants don’t have to be boring. This printed pair by VIV Collection is proof of that.

Not into full-length leggings? Try these calf-length ones by Just My Size that are made from a soft and stretchy blend of cotton and spandex.

Alo Yoga is widely known for its cool, current designs when it comes to active wear. We especially love the interlace detail on these leggings.

These performance leggings by Alo Yoga features flat-locked comfort sealing and stir-up foot detail for secure coverage.

These pull-on leggings by Alo Yoga have visible stitching and a concealed key pocket. We love this ombre effect.

The ripped effect isn’t just for denim, ladies. Behold the latest trend in yoga attire: ripped leggings. Try this pair by Alo Yoga.

These Beyond Yoga leggings are extremely soft and has a four-way stretch. The ankle length also adds extra warmth and comfort in the cold winter months.

These Teeki leggings are pretty much perfect for any outdoor or indoor activity. The fun print is sure to motivate you to get moving.

We can’t decide if the best thing about these Onzie leggings is the print or the fact that they’re made of shrink-resistant and quick-dry fabric.

Love to stay active? Check out our roundup of the best-selling sports bras on the internet!

Splurge Or Save: The Skincare Products You Should Be Investing In

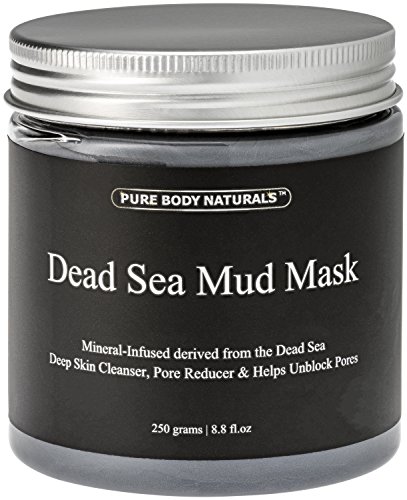

As die-hard beauty junkies, we understand the cost of having great skin. And sometimes, that cost is extremely expensive. While there’s no better feeling than buying, unwrapping and applying expensive skincare products, it’s impossible not to ask the question: Is the high price tag really worth it?

In an effort to banish buyer’s remorse forever, we turn to Los Angeles-based esthetician and owner of Gregory Dylan Beauty to find out (once and for all) what products we should splurge on and which products to save on. With 20 years of experience in the skincare and beauty business, it’s safe to say Dylan is an expert when it comes to skincare.

Keep reading to find out which steps of your skincare regimen are worth the splurge.

“If you love it, buy it,” Dylan says. “If it works, regardless of the price, go ahead and get it if it’s doing the right job for your skin.” But, he also advises that you don’t have to break the bank on your facial cleanser to see results. “It has a pretty basic job and it doesn’t stay on your skin, so if you’re on a budget, I would move that $50 balance to another part of your skincare routine,” he says. “The most important thing with a cleanser is that it cleanses without leaving your skin too tight and dry.” Dylan recommends Clarins Gentle Foaming Cleanser ($24) as a great budget-friendly option. “It’s effective and not too harsh,” he says. “I love to use it with my Clarisonic and get a little extra exfoliation.”

Dylan recommends straying away from drugstore toners, which are often loaded with alcohol and are extremely drying on the skin. However, he also doesn’t advise spending more than $30 on this skincare step. “Unless it has a specific ingredient your skin needs, don’t overspend in this area,” he cautions. “The ingredients evaporate and aren’t going to sink in, so just like a cleanser that you rinse off, toners aren’t super heavy-hitting products. There are better places to invest your money.” He suggests Clinique’s Clarifying Lotion ($23). “I only use it once a day as needed for a bump of salicylic acid, which helps prevent congestion on the skin.”

“This is where you want to put a lot of your money,” Dylan says. “Serums are going to perform above and beyond a lot of your regular skincare because they are developed with a higher concentration of active ingredients and you get better penetration of those ingredients as well.”

Serums also allow you to pinpoint and target your treatments to your skin’s specific needs, which makes it a great place to invest with your beauty budget. “If you’re looking for something that’s going to help with congestion and texture, an AHA or salicylic acid serum is fantastic. Or, if you’re battling pigmentation, try a serum with licorice root or kojic acid,” Dylan recommends. “Serums are the ideal way to tweak your regimen and they pack a lot of punch.” One of Dylan’s favorites to splurge on is Trish McEvoy’s Beauty Booster Serum($128). “It plumps and binds moisture to the skin, so you’re going to notice firming and bounce in any areas with fine lines,” he says.

“Eye cream and serum are two places I would definitely invest my money,” Dylan says. “The sensitive eye area is the first place you’ll see signs of aging, so you want to bump it up.” Dylan’s holy-grail choice is Chanel’s Sublimage La Crème Yeux Ultimate Skin Regeneration Eye Cream ($225). “It performs unlike any other eye cream I’ve ever tried, and it’s perfect for someone who has anti-aging concerns,” he says. For less expensive options, Dylan also recommends Clarins’ Super Restorative Total Eye Concentrate ($83) and Kiehl’s Powerful Wrinkly Reducing Cream ($47).

“You don’t want to use your miracle products during the day,” Dylan says. “When you’re exposed to sunlight a lot of ingredients start to lose their efficacy, so I prefer to use my action ingredients at night when I want to repair.”

In the daytime, Dylan recommends focusing solely on antioxidant protection. He suggests to use Soveral Formula 1 Skin Life Support Moisturizer, 15ml, ($39) or Neutrogena’s Healthy Skin Anti-Wrinkle Cream ($15). On the flip side, he loves Dr. Brandt’s Glwow Overnight Resurfacing Serum ($85), Peter Thomas Roth’s Un-Wrinkle Night and Sunday Riley Artemis Hydroactive Cellular Face O il, 30ml, ($75) to give the skin a little nightly TLC. But, you can also find cheaper alternatives at the drugstore. “A really nice steal is Burt’s Bees Vitamin E Oil ,” says Dylan. “It’s a great AHA cream with nice results.”

Just like daytime moisturizers and creams, you don’t want to max out on sun protection either. “Sunscreen and sunblock all have the same standard ingredients, so it’s not a great place to invest your money,” Dylan says. “I wouldn’t spend above $30.”

“The most important thing about sunscreen is that you like it and it feels comfortable enough on the skin so you wear it every day,” he continues. “It should be light and it shouldn’t leave a white tint on your face.” Dylan loves L’Oreal’s Advanced Suncare Silky Sheer BB Face Lotion SPF 50+ and La Roche-Posay’s Anthelios SPF 60 Milk ($36).

“If you’re going to spend the money, you want something with extra value,” says Dylan. Masks (especially evening masks) are often overlooked but masks are key to getting the most flawless skin.

GlamGlow’s SuperMud Clearing Treatment ($69) and Glamglow Youthmud Tinglexfoliate treatment ($69) are two perfect examples because they do a lot more than a just drugstore mud mask. “A mask should give you a result almost instantly,” says Dylan. “You should be able to wake up or take the mask off and see a nice difference, like tighter pores, smoothness or a glow. With your moisturizers, serums and eye creams, you need to be more patient and give them a couple weeks to work.”

For more helpful skincare tips and tricks, subscribe to Gregory Dylan’s YouTube channel, Boy Meets Beauty.

Craving more beauty secrets? Check these stories out:

10 Reasons You Should Be Using Castor Oil Every Day

How to Pay It Forward for (Symbolic) Equal Pay Day

Today, April 2nd, marks how far into the year women have to work (on average) to earn what men earned in the year prior. “Happy” National Equal Pay Day.

So, what’s the story with Equal Pay Day?

In short, it’s your annual reminder that men typically get bigger paychecks than women.Gee, thanks. I won’t celebrate to that.

It’s not about celebrating the fact that we get paid less – it’s about awareness. In the ‘90s, the National Committee on Pay Equity decided to stop talking about the gender pay gap, and actually show people how bad it is instead. Ta-day: Equal Pay Day.

Is the gap the same for all women?

If this number isn’t infuriating enough, it get worse. The pay gap is a lot worse for women of color, Latinas, and moms. How much, on average, do these gender gaps cost us? You might want to sit down before you dive into this. Because it’s a lot: These are the actual equal pay days for 2019:

- Asian women: March 5

- White women: April 19

- Moms: June 10

- Black women: August 22

- Native American women: September 23

- Latinas: November 20

That’s not all; there’s more: According to a recent Forbes post, despite all the “leaning in” we have done, there has been virtually no advancement of women in business. As the study put it: “Progress isn’t just slowed — it’s totally stalled.”

In fact, as we stand right now, it will take over 40 years, on average, to close the gender pay gap — that’s 107 years for Black women and 216 for Latinas.

So, the gender pay gap is still a massive issue, and it’s not going away tomorrow. Depressing, right? Right. So this (symbolic) Equal Pay Day, our friends at Ellevest are highlighting some things you can do to help move the needle. It’s time to pay it forward.

But don’t be too depressed: the progress made in recent years shows that employers and countries recognize the problem, and are trying to make some changes for women to finally get what they deserve: equal paychecks.

Wondering what the pay gap looks like in your own life? You can head to Economic Policy Institute and use the pay gap calculator, which gives you an approximation based on gender, age, education level, and current salary. And if you want to ask for the same pay as a co-worker, you can consult this helpful guide.

Looking to close your own money gap and increase your chances to reach your goals?

Get started investing in minutes with Ellevest, a company designed by women, for women. $0 minimum.

50 Empowering Quotes from Female Leaders

March was Women’s History Month, but who says we can’t celebrate great women all year round. To keep the momentum on, here are inspiring quotes from some amazing women in business, technology, entertainment, and science. These talented ladies include founders of companies, star athletes, and philanthropists who share their advice on conquering failure and owning success.

Not surprisingly, women face obstacles and discrimination in finding funding for their businesses, hiring for positions, and being selected for well-deserved leadership seats. However, that hasn’t stopped women from becoming trailblazing entrepreneurs and leading organizations to wild success. Look to these successful female leaders for advice on finding success, being a strong leader, staying motivated, and even finding strength in failure.

Quotes About Success

Looking for inspiration? Here are some empowering quotes from some amazing women in business, technology, entertainment, and science.

- “We need to get women to the point where they aren’t apologizing. It’s time to take ownership in our success.” – Tory Burch, Fashion Designer and Businesswoman

- “When I was younger, I was a bit of an achievement addict, viewing success like a ladder. I loved the high of climbing to the next rung to get a new title or raise. Today, I look at it more like a mountain with lots of beautiful peaks and valleys that are all totally worthy of my time.” – Michelle Lee, Editor-in-Chief, Allure Magazine

- “The combined voice of women is powerful and it can uplift our communities. We should be standing up for other women at work, telling success stories and banding together so that we can’t be ignored.” –Keemia Ferasat, Founder and CEO of Style Salute

- “It’s easy to kill an idea with a no, but the smartest people in the room learn how to say yes and make it work.” – Lisa Gersh, CEO of Goop

- “Be creative, not perfect. I’d rather an entry-level employee suggest a disruptive idea…than try and be organized in a boring spreadsheet.” – Whitney Wolfe, Founder and CEO of Bumble

- “There’s something so special about a woman who dominates in a man’s world. It takes a certain grace, strength, intelligence, fearlessness, and the nerve to never take no for an answer.” — Rihanna in the March 2017 issue of Harper’s BAZAAR.

Looking for inspiration? Here are some empowering quotes from some amazing women in business, technology, entertainment, and science.

- “I think success needs to be defined on your own terms. If you look to outside sources (friends, media, the internet) for constant validation, you will never feel fulfilled.” – Jaclyn Johnson, Author and CEO of Create and Cultivate

- “You can do anything you want, just not everything. Pick what you want, work harder than most to get it, and believe in yourself.” – Daina Trout, Co-founder of Health-Ade Kombucha

- “Don’t let anyone rob you of your imagination, your creativity, or your curiosity. It’s your place in the world; it’s your life. Go on and do all you can with it, and make it the life you want to live” – Mae Jemison, Engineer and NASA Astronaut

- “I am a Woman Phenomenally. Phenomenal Woman, that’s me.” ―Maya Angelou

Quotes About Failure

Looking for inspiration? Here are some empowering quotes from some amazing women in business, technology, entertainment, and science.

- “Do not be afraid! Do not worry about fear of failure and fear of what others think.” – Bola Sokunbi, Clever Girl Finance

- “When you take risks you learn that there will be times when you succeed and there will be times when you fail and both are equally important.” – Ellen DeGeneres, Comedian and TV Host

- “Failing is a crucial part of success. Every time you fail and get back up, you practice perseverance, which is the key to life. Your strength comes in your ability to recover.” – Michelle Obama, Former FLOTUS

- “There is no innovation and creativity without failure. Period.” – Brené Brown, Research Professor

- “I think it’s great to be flawed. I am hugely flawed, and I like it this way. That’s the fun of life. You fall, get up, make mistakes, learn from them, be human and be you.” – Priyanka Chopra, Actress, Singer, and Film Producer

- “You won’t know until you try. Create without fear. If you mess up, who cares? You learn and move on.” – Michelle McHargue, Talent Partner of Cowboy Ventures

- “Most of the reason we don’t do things is because we’re afraid to fail. I just made a decision one day that I was not going to do things in my life because of fear.” – Sara Blakely, CEO of SPANX

Quotes About Motivation

Looking for inspiration? Here are some empowering quotes from some amazing women in business, technology, entertainment, and science.

- “Whatever the problem, be part of the solution. Don’t just sit around raising questions and pointing out obstacles.” – Tina Fey, Actress, Comedian, and Writer

- “I am lucky that whatever fear I have inside me, my desire to win is always stronger” – Serena Williams, Professional Tennis Player

- “Whether you work for yourself or others, there will be moments when you feel unhappy or stuck. You can’t control everything around you, but in those moments, remind yourself that you are powerful, and that even small, strategic moves can create big shifts for the better.” – Trae Bodge, Lifestyle Journalist and TV Commentator

- “Even if your dream seems unattainable, you can achieve it if you stay focused, driven, and diligent.” – Rebecca Minkoff, Fashion Designer

Looking for inspiration? Here are some empowering quotes from some amazing women in business, technology, entertainment, and science.

- “I learned to push the envelope when it comes to asking questions or making requests. And if you hear ‘that’s not possible,’ then to ask ‘what is possible,’ instead of just saying thank you and leaving.” – Emily Weiss, Founder of Glossier

- “It’s really hard to start a business if you don’t care about it. At the margin, when it’s 2am, it has to be that passion that pushes you forward.” – Katrina Lake, Founder of Stitch Fix

- “Remember that your time is your most valuable asset, so think about if what you’re doing is really what you want to spend your time on, think about if it’s getting you to a place that you want to go in the long run. If it’s not, go do something else.” – Shan-Lyn Ma, Co-founder of Zola

- “If you’re not where you want to be in life, don’t get discouraged. Remember where you are is not your destiny.” – Sharita Humphrey, Financial Educator

Quotes About Leadership

- “A true diva is graceful, and talented, and strong, and fearless and brave and someone with humility.” – Beyoncé Knowles-Carter, Singer and Songwriter

- “You need to have unbound enthusiasm for what you’re building. Energy is contagious, so your team and everyone you interact with feels it.” – Tyler Haney, Founder of Outdoor Voices

- “People respond well to those that are sure of what they want. What people hate most is indecision. Even if I’m completely unsure, I’ll pretend I know exactly what I’m talking about and make a decision.” – Anna Wintour, Editor-in-Chief of Vogue

- “When you exude confidence, others will naturally follow you. Once you have built that self-confidence, make it your priority to lead by example.” – Kendra Scott, Fashion and Accessories Designer

- “I’m tough, I’m ambitious, and I know exactly what I want. If that makes me a bitch, okay.” ― Madonna

Looking for inspiration? Here are some empowering quotes from some amazing women in business, technology, entertainment, and science.

- “Just because you are CEO, don’t think you have landed. You must continually increase your learning, the way you think, and the way you approach the organization.” – Indra Nooyi, CEO of PepsiCo

- “I learned to always take on things I’d never done before. Growth and comfort do not coexist.” – Ginni Rometty, CEO of IBM

- “It’s hard to juggle being a businessperson with being a creative person. You have to organize yourself.” – Vera Wang, Fashion Designer

Quotes About Money

- The most important aspect of keeping your money is being aware of how much of it you are spending.” – Tiffany Aliche, The Budgetnista

- “Financial independence is about more than dollars in the bank…it’s about you living your best life now and replacing the ‘have to dos’ with the ‘get to dos.’” – Naseema McElroy, Financially Intentional

- “Money follows art. Money wants what it can’t buy: class and talent. And remember, while there’s a talent for making money, it takes real talent to know how to spend it.” – Candace Bushnell, Author and TV producer

Looking for inspiration? Here are some empowering quotes from some amazing women in business, technology, entertainment, and science.

- “A big part of financial freedom is having your heart and mind free from worry about the what-ifs of life.” – Suze Orman, Author and Financial Advisor

- “Life-fulfilling work is never about the money—when you feel true passion for something, you instinctively find ways to nurture it.” – Eileen Fisher, Clothing Designer

- “We all know money is power. And women won’t be equal with men until we are financially equal with men. Getting more money into the hands of women is good for women, but it’s also good for their families, for the economy, and for society.” – Sallie Krawcheck, CEO, Ellevest

- “Rarely is happiness about the materialistic items. Those are awesome to have and money is something you need to sustain yourself, but for me I’ve realized money doesn’t make someone happy.” – Ellen Bennett, Chef and Founder of Hedley & Bennett

For when you don’t feel financially empowered, give it a chance to grow.

Financial empowerment is that feeling you get when you know you’re in control of your money versus worrying that your money being in control of you. It’s about knowing your goals and making a plan to reach them and then acting out the plan.

“If you think about the means to have more power, getting a raise is certainly one of them. Investing is another,” says Sallie Krawcheck, CEO and co-founder of Ellevest, a digital financial advisory for women.

Ellevest will help you invest your cash money to save for the big stuff. Think: starting a business, buying a house…or getting that bag. Your move.

Ready to open your investing account? Follow the link below and you’ll be taken to Ellevest for more information

⇒ Get Started Investing With Ellevest

Here are more money topics for you…

Answered: 401(k) vs. IRA? Use Both If You Can

How Much You Should Be Spending On Clothing and Beauty Every Month

How to Build a Capsule Wardrobe That’s Personalized to You

Does your entire wardrobe “spark joy” for you? Chances are, the answer is a hard no. In the spirit of spring cleaning, now is the perfect time to downsize your wardrobe to a capsule of 49 pieces and always have something to wear.

We’ve already talked a little bit about capsule wardrobes, but what exactly are they? In simple terms, a capsule wardrobe is a curated collection of functional and versatile clothing items that can be worn interchangeably. It includes timeless pieces like denim, t-shirts, tank tops, work slacks, blouses, skirts, dresses, and stylish shoes. The exact garments that make up your wardrobe are up to your you, but the purpose of building a capsule wardrobe is to make it easier for your to create many various outfits. You may have a capsule wardrobe consisting entirely of weekend clothes, or you may have one that includes mostly options for work. The specifics are entirely up to you and your lifestyle.

While there are no rules to building a capsule wardrobe, there are a few recommendations for creating your wardrobe. Experts typically recommend including between 37 and 50. You don’t have to have a number, but aim for 50 or fewer pieces. The key is having all of the basics covered with garments that you can mix and match with different types of looks and purposes. With strong timeless key pieces, you can easily change up your day to day look with accessories and jewelry.

Does this sound like a stylish setup you’d like for yourself? If the answer is yes, then keep scrolling to get my top capsule wardrobe-building tips—and shop our favorite pieces for each of the 6 outfit ideas.

How it works:

A capsule wardrobe is created to minimize your closet and declutter your life. You only hold onto your favorite items that are each useful in your weekly wardrobe. Not only will you declutter your closet, but you will declutter your head as well.

Fewer options (with endless combinations) will alleviate some of that getting-ready stress we all experience on a daily basis. Simply look to minimize what you have to roughly 37 items, including tops, pants, dresses, and shoes. This number does NOT include items outside of typical dressing for the day. So worry not, your yoga pants, sports bras, coats, evening gowns, and loungey PJs aren’t included in that 37 item limit.

The benefits:

According to The Washington Post, a capsule wardrobe can make life easier. First of all, you are saving money when you avoid buying unnecessary items. You are also saving time when you no longer can to trying on 7 outfits in the morning to see if something even fits your right. Another benefit The Washington Post mentions is the quality of the clothing you will own. If you are investing in a capsule wardrobe, you’ll want to choose items that will last, and will look great on you in different combinations. So long, cheap-looking skirt you will never wear again.

How to make your capsule wardrobe personalized.

Creating your individual capsule wardrobe is actually not very complicated. Just think of how much stress this will relieve. Minimalism at it’s finest! A few simple steps to getting started (recommended by Caroline Joy) are:

- Pare down your closet to 37 items.

- Wear only those 37 items for three months.

- Don’t go shopping during the season until…(see number 4)

- During the last two weeks of the season, plan and shop for your next capsule.

- The amount you buy for the next capsule is up to you, but less is more.

Scroll through for some capsule wardrobe inspo.

($31) ($24)

Meghan Markle’s Go-To Flats Are Only $120

With royalty comes the best of styles. From her hair and makeup, to her perfectly put together outfits, to her shoes and bags, Meghan Markle is a fashion icon. So it’s no wonder that we are drooling over her fabulous and functional flats.

Lucky for us, these shoes are back in stock, and Nordstrom carries them. Plus, they have different color options.

Keep scrolling to see Markle’s outfit looks, and shop the flats along with other similar, equally stylish but more affordable options.

If you’re like us, and appreciate a good deal, check out some of these look-a-likes from Amazon!

10 Things Fashion Girls Are Buying on Amazon Right Now

Every fashion girl loves to shop– especially while wearing a robe, slippers… and preferably sipping a cup of our favorite matcha green tea or La Colombe draft latte.

To help jump-start your spring fashion wardrobe, we’ve tapped the biggest retailer out there – Amazon – to share their best-selling fashion items. If you’re looking for key items to add to your spring wardrobe, look no further.

Scroll through to check out 10 fashion girl-approved items on Amazon.

Oversized Sunglasses

Nautical Shirts

Light Scarf

Hoop Earrings

Ankle Boots

Faux Fur Jacket

Sun Dresses

White Sneakers

A Beginner’s Investing Guide to Make Your Money Work for You

You’ve decided to start investing. Good for you! Whether you’re just starting out, in the middle of your career, or getting close to retirement age, this means you’ve started to think about your financial future, and how you should manage your money so that it can work for you.

Nobody starts out an expert in invest, and even the best investors in the world were once in the same position as you are now.

So, let’s start with three questions:

- Where should you begin?

- How do you begin?

- How much do you invest?

Those three inquiries might seem overwhelming, especially if you’ve encountered the array of intimidating investing terms—like market capitalization and return on equity—so we’re here to help. We asked Sallie Krawcheck, CEO and co-founder of Ellevest (an online financial advisory for women) for her guidance.

Ready to get started? Here’s what you should know.

Where do you begin?

Most people put off investing because they think they need a lot of money — like thousands of dollars — to start. This could not be more untrue. You can open an investment account and start investing for as little as $5. So if you find yourself on the receiving end of an unexpected chunk of change (whether that’s $5, $20, $1,000 or more), investing it properly could seriously pay off down the road.

The key to building wealth is creating good habits—like regularly putting money away every month. If you make investing a habit now, you’ll be in a stronger financial position down the road, and with the introduction to user-friendly investing apps and robo-advisors, investing has been made more accessible and easier to understand. With the help of investment robo-advisors, investing can be done with small amounts of money, and done with professional help at little to zero cost!

But wait, what is a robo-advisor?

This is a common question and often misunderstood to be a robot that buys and sells your investments for you (which is NOT the case). Here’s a detailed and easy to understand explanation of what a robo advisor is and how they work.

Robo-advisors are computer automated investment platforms. After signing up and filling out a short survey answering questions about your age, income, retirement goals and risk tolerance, the robo-advisor will put together an optimal portfolio for your goals and automatically manage it to stay on track over time.

Some platform charge for this service, but others like Ellevest, offer free investment plans.

⇒ Get Started Investing With Ellevest

How do you begin?

Robo advisors also typically cost less and offer more than a traditional investment advisor, and take out the one-on-one human element from the equation.

Automating your personal finances is one easy way to simplify and maintain control of your money. Similar to setting up your credit card on auto-pay, set up automatic investing every month. Investing isn’t a one and done kind of thing, and if it is automatic, you won’t even miss the money.

If you want to retire, you have to invest. Whether it is through your 401(k), IRA, or your own personal investment portfolio, you need money to work for you (only you working for it).

Ready to open your investing account? Follow the link below and you’ll be taken to Ellevest for more information

⇒ Get Started Investing With Ellevest

Best for Women: Ellevest

Here’s the truth: There are a million and one “reasons” to put investing off: You’re expecting a raise. You aren’t sure if you know enough to get started. You think you don’t have enough. Retirement feels a hundred years away.

But there’s a single, even more, pressing reason why you should start ASAP (like, right now), $100 a day. $4 an hour. $3,000 a month.

That’s how much you could miss out on by waiting to invest.

If you’re like most women, the extent of your investing—if you invest at all—is likely limited to what you save in an employer-sponsored retirement account. That’s because the idea of investing money into the markets can feel intimidating. In fact, 56% of millennial women have money to invest but aren’t doing so because of fear according to a recent SoFi study.

On the one hand, you’ve heard that it can be a great way to grow your money. On the other hand, the ups and downs of the markets may make you nervous about losing your money. “The reality is, women can’t afford to put off investing,” says Sallie Krawcheck, CEO and co-founder of Ellevest.

“Here’s some math that doesn’t add up: Women retire with two-thirds as much money as men do, buuut we live 6–8 years longer. And the longer we wait to get started, the further behind we get. So, if you think about the means to have more power, getting a raise is certainly one of them. Investing is another.”

Ready to attack this retirement thing and check it off the”to-do” list? Get started today. Ellevest creates personalized investment portfolios in under 10 minutes based on your finances and a gender-specific salary curve.

⇒ Get Started Investing With Ellevest

How much do you invest?

If you’re looking for how to open an account, first things first: open an account and ask yourself some questions like How much money do I want to invest?

There’s a common misperception that in order to invest, you need to first amass a large fortune. That’s not true. You can open accounts with $0—you won’t earn anything, but you can open the account.

And with as little as $1, you can start investing in exchange-traded funds, or ETFs through a digital financial advisory. All you need to do is open an account with a brokerage, which you can do online. Some popular choices are E*Trade, Ellevest, Charles Schwab, or Fidelity. Which type of account is right for you depends on your goals and income.

Sallie Krawcheck, whom I mentioned earlier, founded Ellevest with the specific goal of closing the investing gender gap. The company aims to serve women’s needs better than any other existing system by using an algorithm tailored specifically to women’s incomes and life cycles.

Sign up for a free account with Ellevest today. Get started in minutes.

If you’re looking for some motivation

Retirement. Ahhhh. First: Picture yourself when you retire. Get specific about it — what does your day look like? It can help with the planning process to visualize something tangible to shoot for.

Retirement looks different for everyone (if you even retire at all, that is). If you like the idea of spending your retirement years on the beach sipping Mai Tai’s, you gotta start saving (like now). Depending on your job situation, you may have a 401k, an IRA, a SEP IRA. And when it comes to retirement talk, this is tax code speak for the money you’re saving for retirement.

Sign up for a free account with Ellevest today. Get started in minutes.

If you’re wondering which account type is best for you

For most people, the decision is between an IRA and a 401(k). Both have tax advantages, but they’re different in some key ways. Here’s an in-depth explainer on what they are and how to decide which one’s best for you.

Then, once you’ve decided on either an IRA or a 401(k), you might find yourself with another decision to make: Roth or traditional? Or both? The difference here has to do with taxes and timing. For help deciding, check out the explainers here on Roth vs traditional IRAs and Roth vs traditional 401(k)s.

And if you’re self-employed, there’s a special type of IRA to consider: the SEP IRA. Here’s the breakdown on them and why they tend to be such good options for the self-employed.

Got a traditional, Roth, or SEP IRA that you need to roll over? Check it off your to-do list. Get started here.

If you’re trying to figure out how much you actually need to save

How much do I need? This answer is different for everyone.

Ellevest can help you answer this question, too. Their investing platform makes it really easy (dare I say — fun) to understand how much you need. All you do is enter your personal info into consideration — things like your gender, savings, income, and projected future income — and Ellevest gives you a plan designed to help you get where they think you’ll need to be. They also suggest how much you should put aside for retirement. As a rule of thumb, many advisors recommend the 50/30/20 rule when it comes to how much you should budget for retirement. It’s a high-level, flexible budgeting framework that can help you control where your money’s going without having to count every penny.

Create a free financial plan with Ellevest. They’ll recommend a retirement goal number, down to the dollar.

If you aren’t sure how this whole 401(k) employer match thing works

Did someone say “free money?” Yep … it was your employer. If you have a 401(k) employer match available to you, it’s in your best interest to take full advantage of that. (aka max it out. Here’s how a 401k match works and why that’s the case.

Be a woman with a plan. Invest in Under 10 Minutes.

If you have an old 401(k) or two from a past job just hanging out

Hey, it happens to the best of us. There are a lot of variables involves when you move from an employer and get a new job, and it’s easy to let a former employer’s 401(k) or two get left behind. The good news is that if you left it, you can probably still roll it over — either into your current employer’s 401(k) or an IRA — even if it’s been hanging out for a while. Not sure what that involves? Ellevest can help you answer this question, too and help you start your roll over — no strings attached (more on that below).

Have an old 401k that you don’t know where it is? Ellevest can help you find and move that old 401(k) or 403(b) over.

Start your rollover With Ellevest today.

If you think you might be paying too much in fees

It’s possible. In fact, high fees on your investments are really bad news for your bottom line. According to the Securities and Exchange Commission (aka the SEC), higher fees can cost you tens of thousands of dollars over a 20-year timeline. So, how can you find out if your fees are too high?

Basically, there are two ways of finding out. First, you can start a rollover — for either an IRA or a 401(k) — to Ellevest, no strings attached. They’ll take a look at the fees you’re paying now and let you know what they think your best bet is going forward, even that doesn’t mean recommending that you switch to them. Why? Because, they’re a fiduciary (aka they’re the good guys) and being a fiduciary means that since we’re an SEC-registered investment advisor — so, they’re obligated to act in your best interests.

But the financial industry doesn’t follow the same standards when it comes to providing investment advice to clients. Investment advisors like Ellevest have a duty to put your needs first. No ifs, ands, or buts about it.

So, do your research. I did my due diligence and most of the 401(k) plans I saw had higher fees than Ellevest’s do. So, I’m happy I used them. Either way, no matter where you start with your retirement planning and investing, the most important thing is that you get started. (Because you don’t get that fabulous — Mai Tai sipping — future retired life if you don’t do that.)

For when you don’t have a retirement fund…

Don’t sound the alarm – yet. Ellevest can get you set up in less than 10 minutes so you can reach all of your money goals. Sans judgment, finance jargon, and trust issues. Crisis averted. Get into it here.*

Want more? Here are a few more personal finance pieces:

How to Divvy Up Your Paycheck for Financial Success: The 50/30/20 Rule

The Personal Finance Tips Everyone In Their 20s Should Follow

3 Reasons Why You Need a Roth IRA- Even If You Have a 401(k)

Disclosures: We’re excited to be working with Ellevest to start this conversation about women and money. We receive compensation if you become an Ellevest client.

Questions? We’re here to help. Leave us a comment and we’ll get back to you!

Can Money Buy You Happiness?

You know the old adage: Money doesn’t buy you happiness. This certainly may be true in many aspects, but recent research tells us that overall health and happiness may have more to to do with your financial security than you think.

So, can money really buy happiness?

Perhaps not, but saving and spending money wisely can make life less stressful and add more joy to your life. If your healthy self is going to be living a long life, you’ll need the wealth to get you through retirement.

Blackrock’s recent report uncovers the connection between well-being and wealth, and we’re diving into it. Blackrock conducted the survey, which included 120 in-depth conversation and and 27,000 additional responses, with quotas on gender, age, and health.

The report results speak to what we already know about well-being and wealth: that good health and good finances are related. When one gets better, so does the other. So, what is the real connection and how can we have both?

Keep reading as we get deeper to understand the connection between your wealth and well-being. And why you feel the way you do.

The big connection

Healthy people take care of themselves. They eat well, exercise, and practice self-care. Taking care of your finances can have the same benefits. Often, taking care of health issues can be costly, and having the financial security to preventatively and reactively take care of oneself is SO important.

According to the American Psychology Association, “women report higher levels of stress about money than men.” Adding to this is the fact that 1 in 5 Americans say they have either considered skipping or skipped going to the doctor in the last year…because of financial concerns.” The connection between financial security and overall well-being stems from taking control of your life in one way, and gaining confidence in the process.

What did the survey results find?

When people take a step to invest, they create a greater sense of well-being today. That’s true regardless of affluence, age, gender or life stage.

But even with financial confidence and optimism on the upswing, people aren’t investing — especially women. Despite findings that 43% of people that invest feel more optimistic about their futures, Blackrock found that 57% of people are NOT investing money into stocks or bonds. Some of the cited reasons included being “more interested in achieving short-term goals” and “afraid of losing it all.” People also had the common sentiment of feeling that they are too worried about their financial situation today to think about the future, and that investing is too overwhelming to get started with.

How to have wealth and health?

The truth is that investing and a greater sense of well-being are attainable for everyone. The survey cites further research that by taking small steps towards investing, you can feel good now and in control of the future. In fact, 30% OF non-investors who are not invested want a way to try out investing with a low money commitment.

The way forward

Make this the year you start investing, even just a little bit. If you’re just starting out, choose an investment service with a $0 minimum and low fees that is a fiduciary , meaning they are required to act in your best financial interest. Then start investing as soon as you’ve paid off any bad debt.

Not sure how much to invest? The 50/30/20 rule is a great one — and if you’re not there yet, it’s one to aim for.This is the inequality we can start working on all by ourselves. With that in mind, Blackrock put together 4 steps that lead to financial well-being.

1. “Make a little go a long way.”

Micro-investing (investing small amounts of money) can lead to a greater return than just letting it sit in a savings account where it isn’t working for you.

It’s possible (and smart) to invest even small amounts of money. Many people start off investing this way, a little at a time, and financial firms understand this. That’s why Ellevest is giving Style Salute readers (that’s you!) a $25 toward your first funded goal if they start investing today.

There’s a common misperception that in order to invest, you need to first be rich. That’s not true. You can open an account with with Ellevest for $1.

Ready to open your investing account? Follow the link below and you’ll be taken to Ellevest for more information

⇒ Get Started Investing With Ellevest

2.”Find a good teacher.”

According to the survey, 76% of investors that use a financial advisor reporthaving a positive sense of well-being.

Start a relationship with a financial advisor who will work with you and for you. If you feel like you don’t have all the answers, advisors know how to educate. Working with a financial advisor you trust is important for reaching your long-term goals.

3. “Balance the short-term and long-term.”

41o5 f non-investors say they would feel better about their finances if they could better balance their needs today with their needs in the future.

It’s important to keep in mind all goals when starting to invest. Building your wealth for retirement is important, but so are your short-term goals, whatever they may look like for you.

4. “Don’t wait too long.”

69% of non-investors recognize that their future outlook would be better if they started investing now.

Planning for your future by investing your money shouldn’t be put off till tomorrow. It’s one of the most important things you can do for yourself. When you invest your hard-earned dollars can grow faster than if you were to keep it in cash or a savings account.

The sooner you start investing–even small amounts–the longer your money has to grow.

Of course, markets can be volatile but research shows that over the long-run staying in the markets will help your money grow. A lot more so than keeping it in cash.

To learn how to get started investing for women go to Ellevest and get your free financial plan (a great way to see if you like it).

Next up, how to get what you want in a negotiation.

Here are more money topics for you…

The One Money-Habit All Wildly Successful Women Share

The Money Advice Every College Grad Needs to Hear

7 Smart Money Moves to Make in Your 20s

Disclosures: We’re excited to be working with the team at Ellevest to start this conversation about women and money. We may receive compensation if you become an Ellevest client.