Ready for early retirement of sipping Aperol Spritz in Positano all day, every day? First, you need to save and invest in it.

When it comes to personal finance, we have a lot of Qs. And our friends at Ellevest have a lot of answers. Ellevest financial advisor Rachel Sanborn answers some of the biggest questions from our community to help us all get on track to create smart financial habits.

Here are 7 big questions to ask your financial advisor.

1. Are you a fiduciary?

Standards are a good thing to have. And a fiduciary is a person who acts on behalf of another person, or persons to manage their money. … Money managers, financial advisors, bankers, accountants, executors, board members, and corporate officers can all be considered fiduciaries. But, unfortunately, the financial industry doesn’t always follow the same standards when it comes to providing investment advice to clients. That said, you should always ask any financial advisor your interviewing, “Are you a fiduciary?”

Fiduciaries like Ellevest have a duty to put your needs first. No ifs, ands, or buts about it. Non-fiduciaries need only to recommend products that are “suitable” — even if they’re not the lowest-cost or most ideal for you. That’s why you want to know about the fiduciary rule and ask any potential advisors if they follow that standard.

⇒ Get Started Investing With Ellevest

2. What’s your investment philosophy?

“Just like a romantic relationship, it’s important to ensure you and your financial advisor have the same investment philosophy. Here’s why: You have to believe in what they’re doing to stick with it. For example, at Ellevest, they have a goal-based investment philosophy — IOW, they’re all about getting you to your goals…because in their view, that’s all that matters. So with them, you’ll hear the term “goals-based investing.”

⇒ Get Started Investing With Ellevest

3. What should I do with my cash?

While this question sounds obvious, it’s important to get to the bottom of it from the start.

It’s essential to figure out how much money you should have saved for emergencies, and how much you should start investing. Women tend to hold so much of their assets in cash — 71%, while men hold only 60%. And when you leave your savings in cash, you may miss out on market gains that could be earned over time, and even worse — inflation actually lessens your purchasing power.

So, you have to start talking. And it’s not all that bad. Here’s a scenario: say you have been setting aside your bonuses at work to save for a house. But you’re not quite ready to buy the house, and you don’t know what to do with that cash until you are. That’s where a financial planner comes in. A financial advisor can look at the numbers and your goals and say, “You’ve got 12 months’ worth of expenses in cash.

Let’s keep 3-6 months of your salary in cash, and consider investing the rest toward goals like starting a family, retirement or that new home.

Get Started Investing With Ellevest

4. How do I know if I’m on track for retirement?

Retirement is one of those financial goals that everyone has. Your financial planner understands this very well. This question will open up an important conversation about how much money you will need to retire the way you want, and how you will get there (along with meeting your other financial goals).

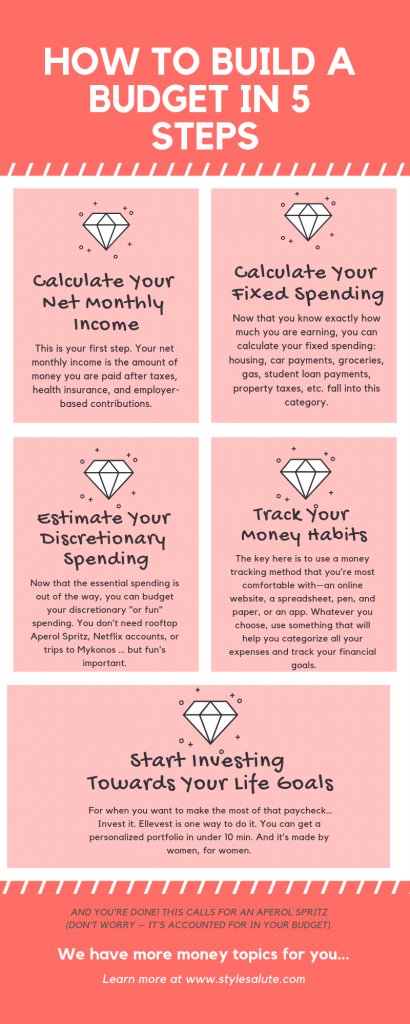

So a financial advisor could go through an exercise in which a client will imagine her future self. For when you want to make the most of that paycheck…Invest it. And if you’re not sure where to start, you can sign up with a digital investment platform. Ellevest is one way to do it. You can get a personalized portfolio in under 10 min. And it’s made by women, for women, with portfolios that allow you to invest in companies that support women (if you choose).

In just 10 minutes, they can help you figure out how much you should be saving now so you can sit back, relax, and go OOO for good. Try it here.*

5. Should I focus on paying down my non-revolving debt (student loan, car loan, mortgage, etc) before investing (beyond my 401(k))? How and when should I start paying off my student loan debt?

There’s a different answer for everyone. It can depend on the kind of debt: There’s good debt and bad debt.

So, the best place to start is to look at the type of debt and the associated interest rates. Paying off debt with higher interest rates and payments that are not tax-deductible, such as credit cards and auto loans (and anything with interest rates over 10%), should be prioritized first. For debt with lower interest rates and/or payments that are tax-deductible, such as student loans or mortgages, you can consider paying the minimum and investing the difference. Overall, the best strategy will depend on your personal situation.

A good financial advisor will look at the current interest rate on the debt vs. long-term investing rates of return (historically 5-10% on average, depending on the mix of stocks and bonds), as well any tax implications.

It can often be more than just financial math, though; it’s really part psychology, too. If the debt is weighing heavily on you and the interest rate on it is pretty close to potential investment rates of return, you should prioritize paying it off first.

Remember: It’s all about YOU.

It’s your financial goals. Your future. People always say that they don’t want to turn financial planning sessions into counseling sessions, but you can’t separate money from emotion.

Looking for a financial planner? Ellevest’s team of Certified Financial Planners can help. The platform aims to serve women’s needs better than any other existing system by using algorithms tailored to your salary, gender, and lifespan (aka your real life).

6. How should I manage old 401(k) plans (from prior jobs), when should one roll them over or start an IRA? Is there an easy way to find any and all accounts we have?

When it comes to managing old employer-sponsored plans, the best approach will depend on your personal situation. Leaving your 401(k) invested “as-is” is an option, but there are several other benefits to rolling over your 401(k) into an IRA.

Before we get into it, it’s important to keep in mind that having all of your accounts in one place can be an effective way to ensure you are staying on top of your financial goals. That said, if you have other retirement savings or accounts elsewhere, it’s probably a good idea to consider rolling your 401(k) over into an IRA with your chosen provider. Second, in addition to allowing you to see your entire retirement savings picture in one place, rolling over into an IRA can provide other important benefits.

Benefits include keeping your retirement savings in a tax-advantaged account, and providing more flexibility to select from a wider range of investments than most employer-sponsored plans typically offer.

If a rollover is right for you, the best time to initiate it will depend on your unique circumstances and priorities. However, in order to take advantage of these key benefits, you may want to explore this option sooner rather than later.

When it comes to locating any and all accounts from old employer-sponsored plans, it’s more straightforward than you think. Because companies are required to mail any abandoned funds to the account owner’s last known address and turn over any unclaimed funds to the state, this process has become a lot easier. Using online resources, like those provided by the National Association of Unclaimed Property Administrators, is a good place to start. Robo-advisors like Ellevest, Betterment and Wealthfront can also help you track down all your old plans and roll them over.

The Bottom Line: Get invested now. If you have a 401(k) or multiple 401(k) plans or IRA just sitting there, and you want to get it to a place where you can track it, how about starting now? Ellevest can help.

7. What’s the difference between financial planners and financial advisors, and at what stage of life should I talk to one?

Put simply, a financial advisor refers to anyone who helps clients manage their money. It can be thought of as an umbrella term that includes different types of financial advisors, such as financial planners.

The decision to use a financial advisor, and finding the advisor that is right for you, is highly personal and depends on your unique needs, preferences, and behaviors. Robo-advisors are great for those new to investing.

When looking for a financial advisor, it’s important to find someone you can trust. Although trust is built over time, there are a few things you can look for to help you determine if you’ll be able to establish trust with an advisor. A good place to start is by determining whether the advisor is a fiduciary (go back to Q1), which means they are required to put your best interests first. Understanding the fee structure of the advisor is also key in determining that there are no conflicts of interest. From there, you can then ask questions to determine whether the advisor’s investment philosophy aligns with your unique needs and long-term goals.

8. When Should I Start Saving for Retirement?

It’s important to know that the earlier you start saving for retirement, the less you’ll have to save in the future, so it’s important to start as soon as possible. So, start with your first paycheck. What if I haven’t started saving? Start right now. It’s not too late to begin to invest. A dollar invested in your 20s is worth much more than your 40s, which is worth much more than your 60s. It’s never too early and it’s never too late.

It’s never too early and it’s never too late.

9. What resources are available for those of us who aren’t ready to talk to an advisor or planner?

Lucky for us, there are now many different resources that can be used to better understand your personal finances and investing. A good place to start is on the Ellevest website, which provides investing information for individuals at all stages of the investing journey.

Here are more personal finance topics for you…

The One Money-Habit All Wildly Successful Women Share

The Personal Finance Tips Everyone In Their 20s Should Follow

3 Reasons Why You Need a Roth IRA- Even If You Have a 401(k)

Questions? We’re here to help. Leave us a comment and we’ll get back to you!