Conventional wisdom suggests women are great savers. Give them some money, they’ll save it. Most data backs this assertion up, too. One recent Vanguard survey, for example, found that women saved up to 16% more than the men, and were 14% more likely to set up 401(k) savings accounts than their male counterparts.

That said, women still don’t have as much money as men. The same Vanguard study found men have 50% more in savings than women. That’s nothing. Building a financial cushion isn’t just about improving one’s lifestyle — e.g. buying a loft apartment and a $400 haircut — it’s about being able to quit the job that is making you sick, having the cash to start your own businesses and being able to get out a rotten relationship without worrying about the finances. And you can’t do any of that unless you are investing toward these goals.

“Son of a gun, the industry today has built a pink wall that I don’t think they meant to build, but that has kept women out of investing,” says Sallie Krawcheck, former Wall Street executive, and founder of women’s investing platform, Ellevest.

Krawcheck ought to know. Not long after graduating college, the former Citigroup CFO landed a job at investment bank Salomon Brothers, a notorious hotbed of toxic masculinity and testosterone. Thanks to some seriously savvy maneuvering, she rose above the fray and carved a successful career for herself in a field that was, to put it delicately, unwelcoming to women.

Now Krawcheck has a new mission: To get women to invest.

Sure, saving is great. But to build real wealth and to have any chance of building a retirement nest egg, women will have to break through whatever barrier is preventing them from becoming investors – whether it’s fear or a feeling that they don’t know enough to get started. Keeping cash in a zero interest rate savings account simply won’t be enough to stay ahead of inflation over the next few years, much less thorough to retirement.

“The earlier you start investing, the better,” says Krawcheck. This is because the money you invest in your 20s is worth exponentially more than what you invest in your 30s or later, thanks to the power of compound interest: which Einstein is said to have called “the most powerful force in the universe.” Your money starts working for you right away, and even small amounts can grow to large amounts over a long investing horizon. So, the sooner you start investing what you’re saving, and those interest payments can be reinvested and begin earning more, the more time you’ll give your money to grow.

It’s not rocket science, it’s just a matter of overcoming inertia.

The problem? “Simply put, women don’t invest as much as men do,” says Krawcheck. “And they don’t invest as early as men do, either.” A recent survey from Ellevest illustrates what she’s talking about, in which fewer than half of the women surveyed felt satisfied with their knowledge of finances. And just 17% reported being satisfied with the advice of their financial adviser. “Women tend to live longer than men and retire with less money. Yet, the finance world remains profoundly oriented toward them,” Krawcheck says.

So, what’s a future-focused, debt-free Boss B to do?

Keep reading to find out the three things Krawcheck says can do right now to jumpstart your financial future.

1. Start Early.

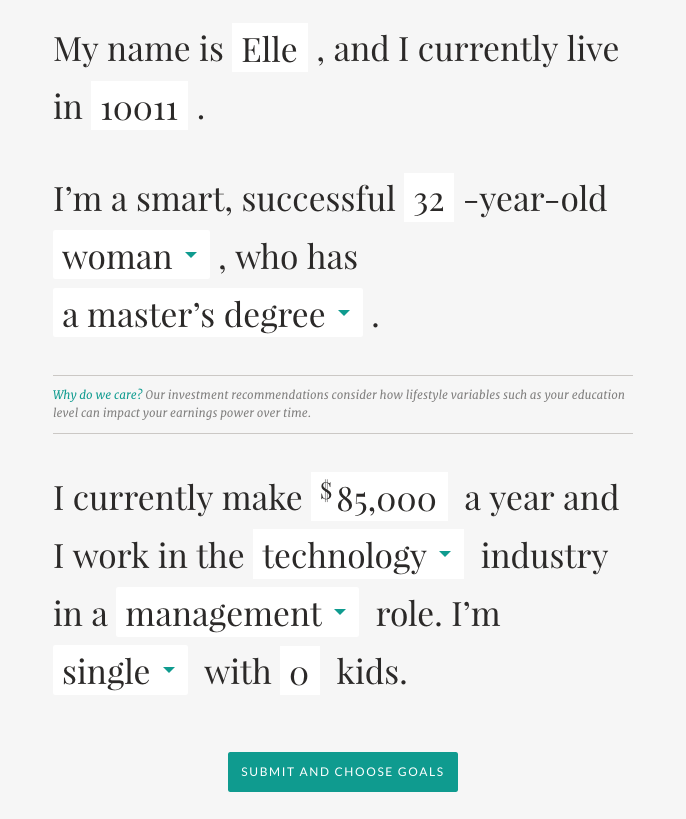

Start Early. The best day to start saving and investing is today, even if you can save only a little bit. Commit to investing. You don’t have to start with a huge sum. You don’t even have to sacrifice your small indulgences (we’re looking at you, grande latte), but you do have to figure out how much you can tuck away every month and actually do it. Ellevest, Krawcheck’s investment platform, makes it easy to create a plan. All you have to do is plug in some basic stats, outline your financial goals, and in a matter of seconds, you get an investment strategy with specific suggestions of how to reach your target numbers.

Plus, while most traditional advisors charge upwards of $1,000 for a financial plan. Ellevest is working to close the gender investing gap, so they don’t charge a penny for this first key step in taking financial control. They believe that every woman should have a plan — and that’s why theirs is totally free. Plus, it takes less time to customize than watching an episode of The Office. You can save your Ellevest financial plan, come back to it, adjust it, or share it, whether you invest with Ellevest or not.

There is no better way to narrow the wealth gap than through a shrewd investment strategy. Done right, it shouldn’t be painful. In fact, it’s fun. It just needs to be done consistently.

“The right way to invest is a percent out of every paycheck,” Krawcheck says.

Diligence shouldn’t be confused with deprivation, though. Don’t restrict yourself to an exclusive diet of ramen or force yourself to eat on $3 per day. Broadly speaking, Krawcheck suggests 50% of your income should be allotted to your needs; 30% to fun; and 20% to future you (more on that here).

2. Track down your money, make it work for you.

If you want to start investing, the first thing you need to do is get hold of all your money. Remember that retirement account from your first job out of college? Or that savings bond that was given to you by your grandmother for your 12th birthday? Go get it.

Yes, it’s commendable that you started that 401(k) when you were 22, but if you switched jobs twice and moved three times since then, you may have lost your hard-earned money in a black hole. Find it, consolidate it, and make active decisions about how to grow it. The good news? You don’t have to check a bunch of different sites and do the planning yourself. Ellevest groups all your retirement accounts — even those outside of Ellevest — into one place on your dashboard.

This means no mountain of paperwork or making you figure out everything on your own.

“If we’re not investing, we’re doing most of the hard work around money (you know, going to work every day, turning in that amazing design, landing the difficult-to-close client, beating our sales projections), but we’re only getting about half the reward,” Krawcheck says.

3. Go easy on yourself.

No, you don’t have to stay up all night studying market fluctuations. You don’t have to harass your banker friends for stock tips. Don’t try to outsmart the market because the market (almost) always wins.

If you park your money in an index fund (a fund that mimics a major market index, such as the Standard & Poor’s 500 Index), you don’t have to tend to your investments on an hourly or even daily basis. Sit back and let your money grow with the market. Since 1928, the market has delivered plump 9.5% returns. So, all that talk about fluctuations? You just have to be patient.

“Investing is one of the most important things you can do for yourself. It will build your wealth….not by a little, but by enough to make a real difference in your life.” – Sallie Krawcheck.

Ready? your complimentary financial plan from Ellevest today — you honestly have nothing to lose.

Disclosures: We’re excited to be teaming up with Ellevest to start this conversation about women and money. We receive compensation if you become an Ellevest client.